Core banking systems serve as the backbone of financial operations and customer interactions for banks worldwide. They facilitate critical transactions like loan management, withdrawals, and deposits in real-time.

However, maintaining such a system comes at a hefty cost. Financial institutions (FIs) are spending up to US$100 billion annually on technology to remain competitive. Modern all-in-one platforms offer efficiency improvements, scalability, comprehensive data analytics, robust security measures, and cost savings.

The necessity for digital transformation

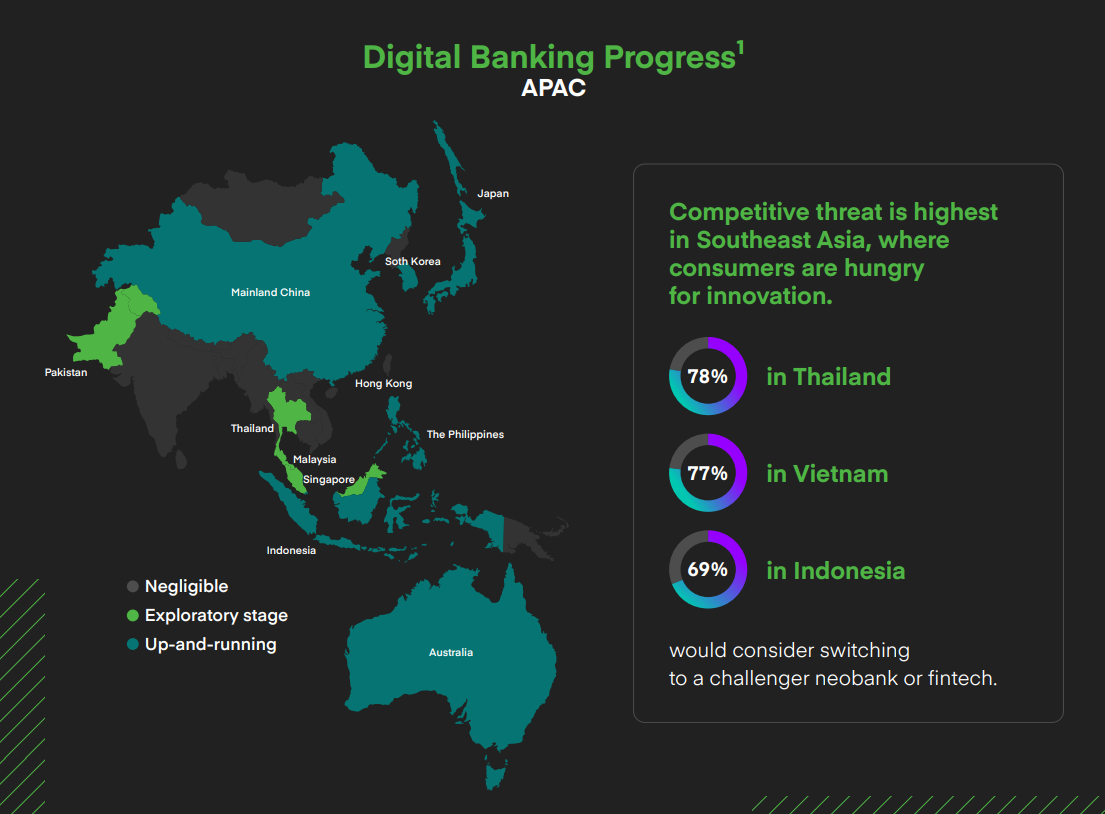

The COVID-19 pandemic and increased competition have accelerated digital transformation in Asia-Pacific FIs. Customers increasingly rely on digital channels, prompting banks to allocate more resources to technology budgets.

However, simply maintaining legacy systems is no longer sufficient. Older IT stacks represent significant technical debt, hindering innovation, uptime, and meeting market needs.

Investments in technology drive digital maturity, product agility, data-driven personalisation, and enhance the financial experience.

Despite having clear digital strategies, over 80% of APAC banks have yet to achieve their digitalisation goals. The emergence of digital-native banks and fintech firms poses a significant threat to traditional incumbent banks.

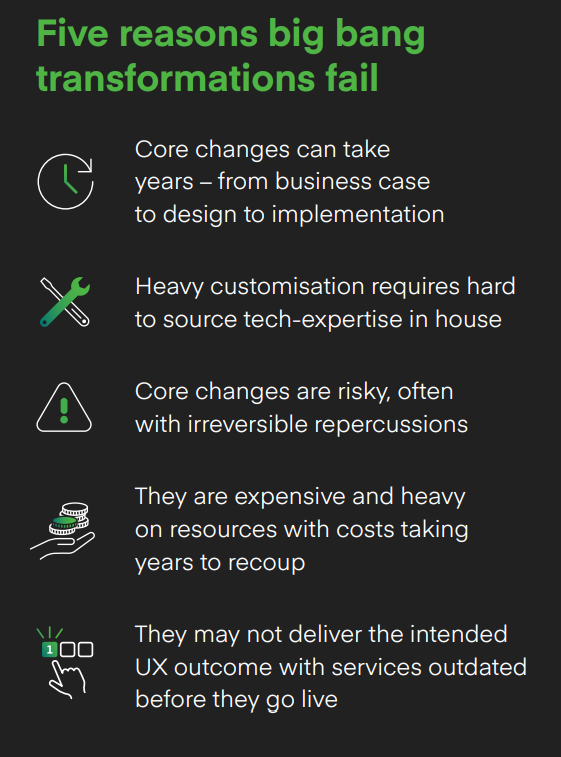

The problems of a ‘Big Bang’ approach

A ‘big bang’ legacy replacement can promise a swift solution to outdated core banking systems’ problems. However, this approach often brings about more problems than benefits.

The scale and complexity of replacing an entire legacy system can overwhelm resources and lead to prolonged implementation timelines and substantial cost overruns.

Additionally, the risk of operational disruptions during the transition period is significantly higher.

Consider incremental changes

Incremental change using dual and parallel core platforms is suggested as a strategy with less risk and lower cost compared to a ‘big bang’ approach.

Dual core platforms involve progressively migrating customers based on key lifecycle events, while parallel core platforms entail launching new customer propositions and experiences and then migrating existing customers.

Incremental transformations take months to complete, without disruption to critical systems.

Four advantages of incremental transformation

How can Mambu help

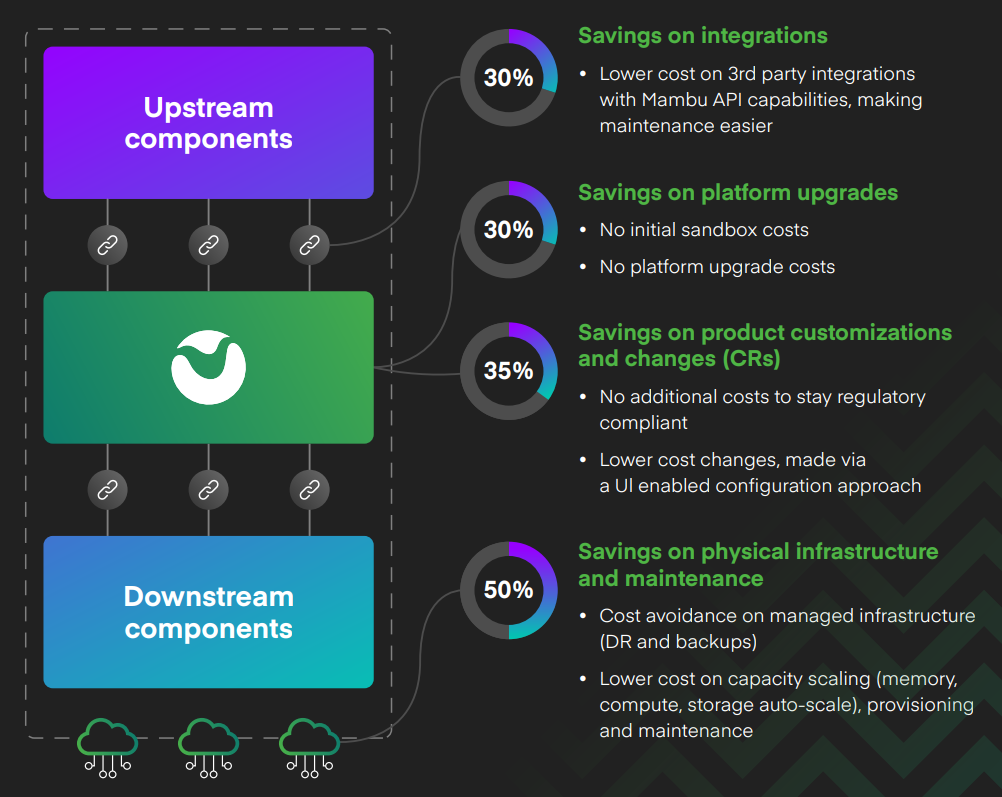

Cloud banking platform Mambu enable banks complete their transformations quickly and with operational stability, at a fraction of the cost of a ‘rip and replace’ approach.

It enables a test-and-learn methodology, allowing organisations to evolve gradually while minimising disruption to services.

The single software-as-a-service (SaaS) solution suits all banking functions, ensuring commercial alignment, and Mambu’s network of third-party partners can further tailor the platform to specific business requirements.

Fernando Zandona

Fernando Zandona, CEO of Mambu said,

“Asia Pacific financial institutions that partner with Mambu can remain agile while operating on a lean budget and find better and faster ways to meet their customers’ expectations.”

By enlisting Mambu for their incremental digital transformation journey, APAC banks can unlock new opportunities for competitiveness, agility, and customer-centricity in the digital age.

Discover how Mambu can take your core banking systems to the next level for less here.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/92980/digital-transformation/big-bang-bank-upgrades-spell-trouble-mambu-makes-case-for-incremental-change/

- :is

- $UP

- 1

- 14

- 150

- 32

- 400

- 7

- 900

- a

- About

- accelerated

- Achieve

- advantages

- age

- agile

- AI

- alignment

- All

- all-in-one

- allocate

- Allowing

- an

- analytics

- and

- Annually

- APAC

- approach

- ARE

- AS

- At

- author

- Backbone

- Bank

- Banking

- Banks

- based

- begin

- benefits

- Better

- Big

- Big Bang

- Billion

- Brings

- budget

- Budgets

- business

- by

- CAN

- caps

- case

- ceo

- change

- channels

- clear

- comes

- commercial

- compared

- competition

- competitive

- competitiveness

- complete

- complexity

- comprehensive

- content

- Core

- Core Banking

- Cost

- cost savings

- COVID-19

- COVID-19 pandemic

- critical

- customer

- Customers

- data

- Data Analytics

- data-driven

- Debt

- deposits

- digital

- digital age

- Digital Transformation

- digitalisation

- Disruption

- disruptions

- drive

- dual

- during

- efficiency

- emergence

- enable

- enables

- end

- enhance

- ensuring

- Entire

- events

- evolve

- existing

- expectations

- experience

- Experiences

- facilitate

- faster

- financial

- Financial institutions

- Find

- fintech

- Fintech News

- firms

- FIS

- For

- form

- fraction

- functions

- further

- Goals

- gradually

- Have

- having

- hefty

- High

- higher

- hottest

- How

- However

- HTTPS

- implementation

- improvements

- in

- increased

- increasingly

- incremental

- Incumbent

- Innovation

- institutions

- interactions

- involve

- IT

- journey

- jpg

- Key

- launching

- lead

- Legacy

- less

- Level

- lifecycle

- like

- loan

- longer

- lower

- mailchimp

- Maintaining

- MAKES

- Mambu

- management

- Market

- maturity

- max-width

- measures

- Meet

- meeting

- Methodology

- migrating

- Modern

- Month

- months

- more

- necessity

- needs

- network

- New

- news

- next

- no

- of

- offer

- often

- older

- on

- once

- operating

- operational

- Operations

- opportunities

- Organisations

- outdated

- over

- Pacific

- pandemic

- Parallel

- partner

- partners

- period

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- poses

- Posts

- problems

- Product

- progressively

- promise

- propositions

- quickly

- real-time

- rely

- remain

- replacement

- represent

- Requirements

- Resources

- Risk

- robust

- SaaS

- Said

- Savings

- Scalability

- Scale

- security

- Security Measures

- serve

- Services

- significant

- significantly

- simply

- Singapore

- single

- solution

- specific

- SPELL

- Spending

- Stability

- Stacks

- strategies

- Strategy

- substantial

- such

- sufficient

- SWIFT

- system

- Systems

- tailor

- Take

- Technical

- Technology

- technology budgets

- than

- that

- The

- their

- then

- they

- third-party

- this

- threat

- timelines

- to

- traditional

- Transactions

- Transformation

- transformations

- transition

- trouble

- unlock

- upgrades

- uptime

- using

- ways

- webp

- while

- with

- Withdrawals

- without

- worldwide

- yet

- Your

- zephyrnet