SNEAK PEEK

- Messari highlights how integrating Chainlink’s PoR can minimize losses.

- The firm emphasizes the necessity of setting standards beyond CEXs.

- Chainlink’s daily updates have surged, covering over $8.5 billion.

Crypto enthusiasts have long been concerned about the industry’s lack of transparency and accountability, particularly when it comes to centralized exchanges (CEXs) and stablecoin reserves. However, Messari, a leading crypto research firm, highlights a potential solution in its recent report. They shed light on Chainlink’s Proof of Reserves (PoR), a mechanism that could revolutionize how reserves are verified and data is delivered securely.

1/ Following the FTX collapse, crypto aims to set standards for centralized exchanges (CEXs) with Proof of Reserves.

But as stablecoin reserves expand, proof of reserves should extend beyond CEXs.@CabronElBufon discusses how @Chainlink‘s data feeds can facilitate this. 🧵 pic.twitter.com/sCAL3oJtdF

— Messari (@MessariCrypto) June 22, 2023

In the report, Messari emphasizes the urgent need for standards in the crypto space, particularly during the FTX collapse. While FTX’s downfall has sparked discussions around setting standards for CEXs, Messari believes that proof of reserves should extend beyond these exchanges. This is where Chainlink’s PoR comes into play.

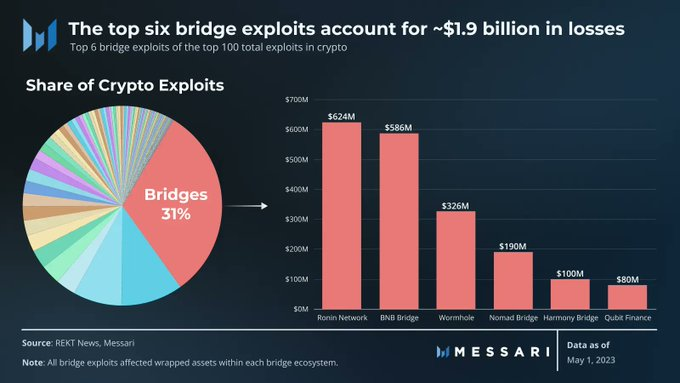

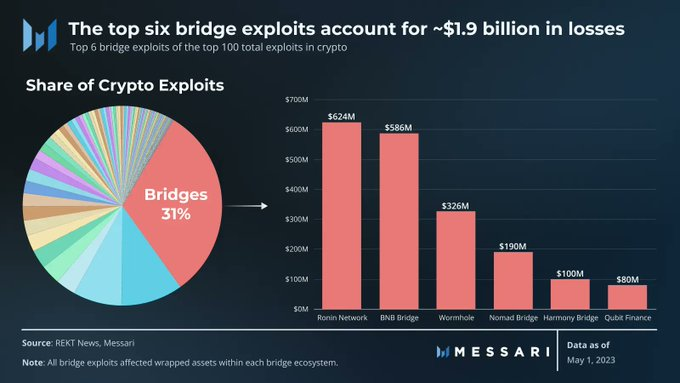

By integrating Chainlink’s PoR, developers can minimize losses from hacks and exploits. According to Messari, the top six bridge exploits alone have led to a staggering loss of $1.9 billion. Implementing Chainlink’s PoR could have alerted protocols earlier about these attacks, mitigating the damage.

So, what sets Chainlink apart as the ideal entity to deliver PoR? Messari points out that Chainlink has already made significant strides in this domain. With over 1.4 million PoR updates covering 20 assets, Chainlink’s daily updates witnessed an impressive 200-350% surge in July 2022. Currently, Chainlink’s PoR covers a value of over $8.5 billion, encompassing wrapped assets on Ethereum, Avalanche, and Polygon.

However, the report acknowledges that challenges remain for Chainlink’s PoR. The process introduces risks if misused, including trust in off-chain data sources, the number of oracles per data feed, and the potential for stolen collateral. Despite these challenges, Messari believes that Chainlink’s PoR is a robust mechanism that enhances transparency in crypto products.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://investorbites.com/chainlinks-por-to-enhance-transparency-in-crypto-products/

- :has

- :is

- :where

- 1

- 10

- 11

- 20

- 2022

- 22

- 9

- a

- About

- According

- accountability

- aims

- alone

- already

- an

- and

- apart

- ARE

- around

- AS

- Assets

- Attacks

- Avalanche

- been

- believes

- Beyond

- Billion

- BRIDGE

- CAN

- Center

- centralized

- Centralized Exchanges

- CEXs

- Chainlink

- challenges

- Collapse

- Collateral

- comes

- concerned

- could

- covering

- Covers

- crypto

- crypto space

- Currently

- daily

- data

- deliver

- delivered

- Despite

- developers

- discussion

- discussions

- domain

- downfall

- during

- Earlier

- emphasizes

- encompassing

- enhance

- Enhances

- enthusiasts

- entity

- ethereum

- Exchanges

- Expand

- exploits

- extend

- extensive

- external

- facilitate

- facts

- Firm

- following

- For

- from

- FTX

- ftx collapse

- hacks

- Have

- highlights

- How

- However

- HTTPS

- ideal

- if

- implementing

- important

- impressive

- in

- Including

- industry’s

- Integrating

- internal

- into

- Introduces

- investor

- IT

- ITS

- July

- Lack

- largest

- leading

- Led

- light

- Long

- loss

- losses

- made

- mechanism

- Messari

- million

- mitigating

- Need

- network

- news

- number

- of

- on

- Oracles

- out

- over

- particularly

- plato

- Plato Data Intelligence

- PlatoData

- Play

- Polygon

- POR

- potential

- process

- Products

- proof

- protocols

- recent

- remain

- report

- research

- reserves

- Revealed

- revolutionize

- risks

- robust

- s

- securely

- set

- Sets

- setting

- shed

- should

- significant

- SIX

- solution

- Sources

- Space

- sparked

- stablecoin

- Stablecoin Reserves

- standards

- stolen

- strides

- surge

- Surged

- that

- The

- These

- they

- this

- to

- top

- Transparency

- Trust

- Updates

- urgent

- value

- verified

- What

- What is

- when

- while

- with

- witnessed

- Wrapped

- zephyrnet