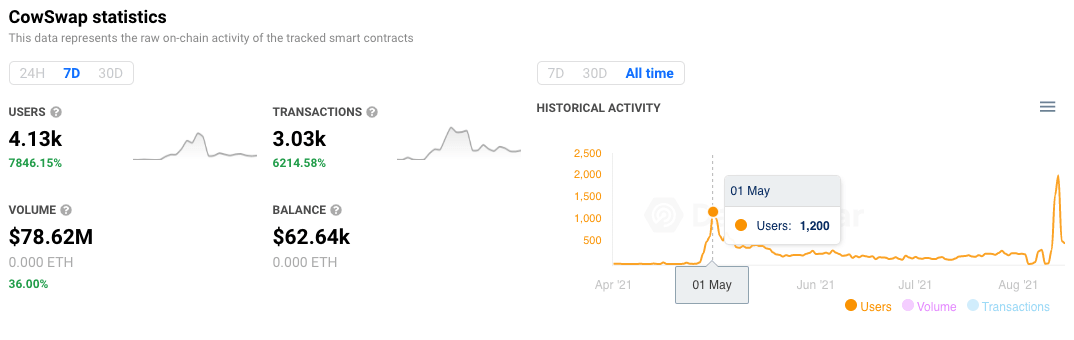

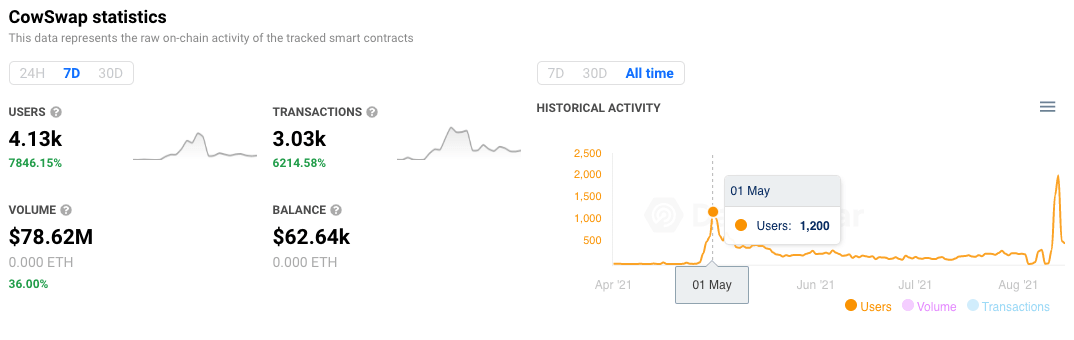

Driving a record $78 million in volume in the last 7-days

CowSwap, an innovative trading platform running on the Gnosis Protocol offering users peer-to-peer trading without gas fees, has seen a huge surge in its active wallets and transactions. In the last 7 days, the protocol has attracted a record number of unique active wallets and seen its volume swell to over $78 million.

At the time of writing, the CowSwap protocol has attracted a record number of 4,130 unique active wallets in the last 7-days. These users drove just over 3,000 transactions, generating over $78 million in volume. Importantly the previous highest number of unique active wallets in a single day was 1,200. Occurring back in May, around the time the platform originally launched. In that context, we can assume that CowSwap attracting almost 4x the number of wallets had to have been stimulated by an event or product upgrade.

What’s Happening?

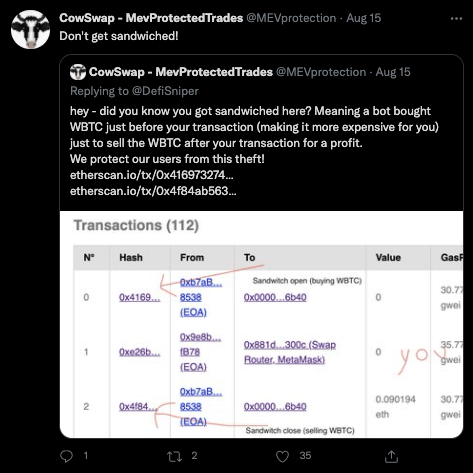

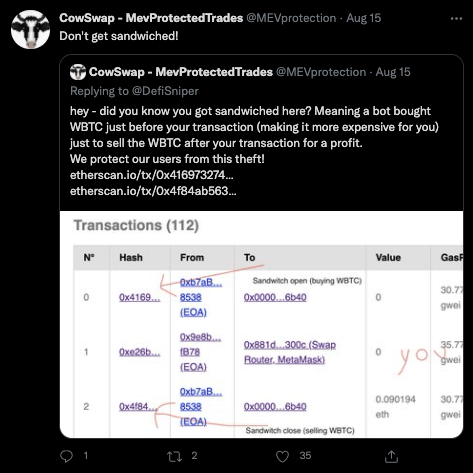

On the 11th of August, the platform announced that it would be upgrading to audited smart contracts that include tight integration with Balancer’s new vault architecture. Marking the evolution of CowSwap from its alpha phase release to its first stable and audited version. As a direct result users can now enjoy Miner Extractable Value (MEV) protection, no gas fees for failed transactions, and more. While CowSwap users benefit from better prices due to the optimized pool settlements and use of the Balancer v2 single vault architecture. Moreover, the platform is heavily promoting its MEV protection and it appears to be differentiating the platform amidst rising competition. The below tweet can explain in layman’s terms why MEV matters to many traders.

Why CowSwap is Different

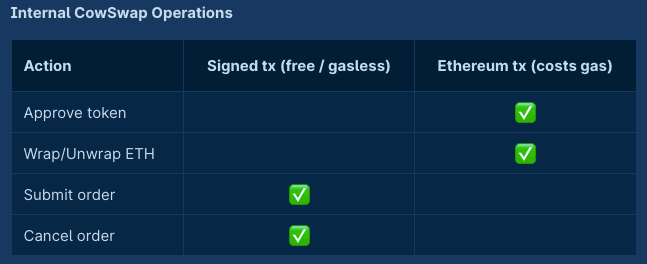

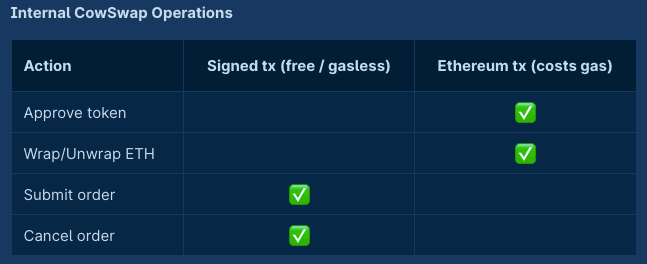

On CowSwap, orders are placed off-chain and are not immediately executed, but rather collected and aggregated to be settled in batches. Which is the price-finding mechanism the protocol uses to settle trades. It uses batch auctions with uniform clearing prices for all trades in the same batch, therefore there is no need for ordering the transactions within a single batch. Because everyone receives the same price across assets it’s not possible for any value to be extracted by placing transactions in a certain order. Batches are settled on-chain by an external, independent party referred to as solvers. Solvers are a person or entity who submits order settlement solutions that maximize trade excess for a given batch.

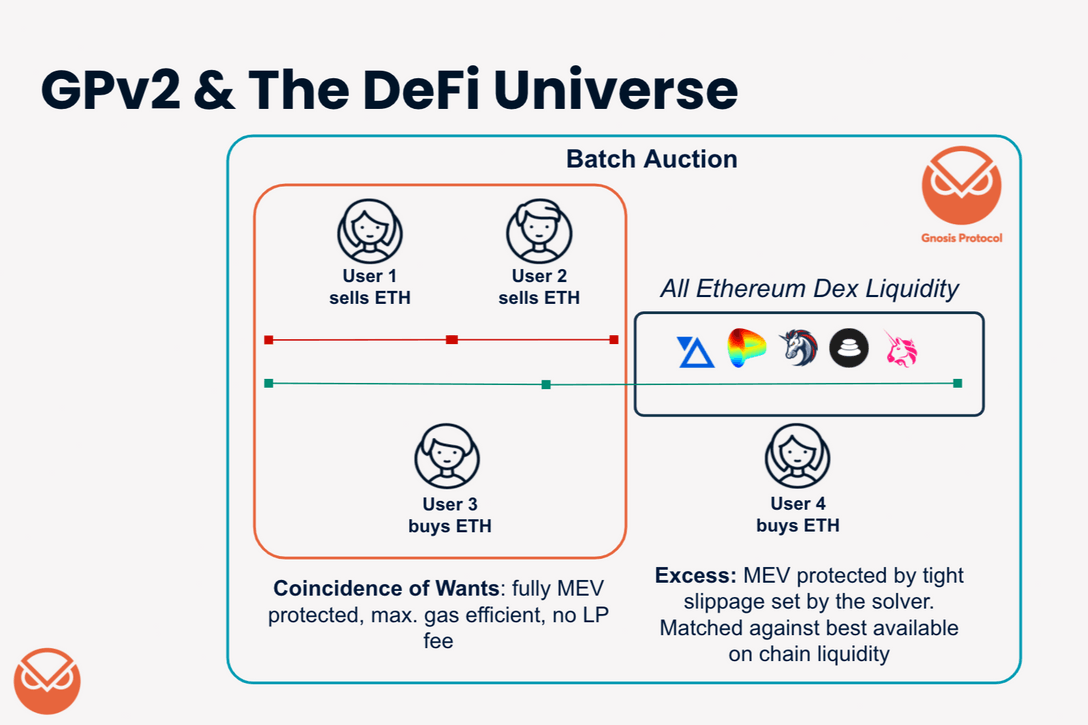

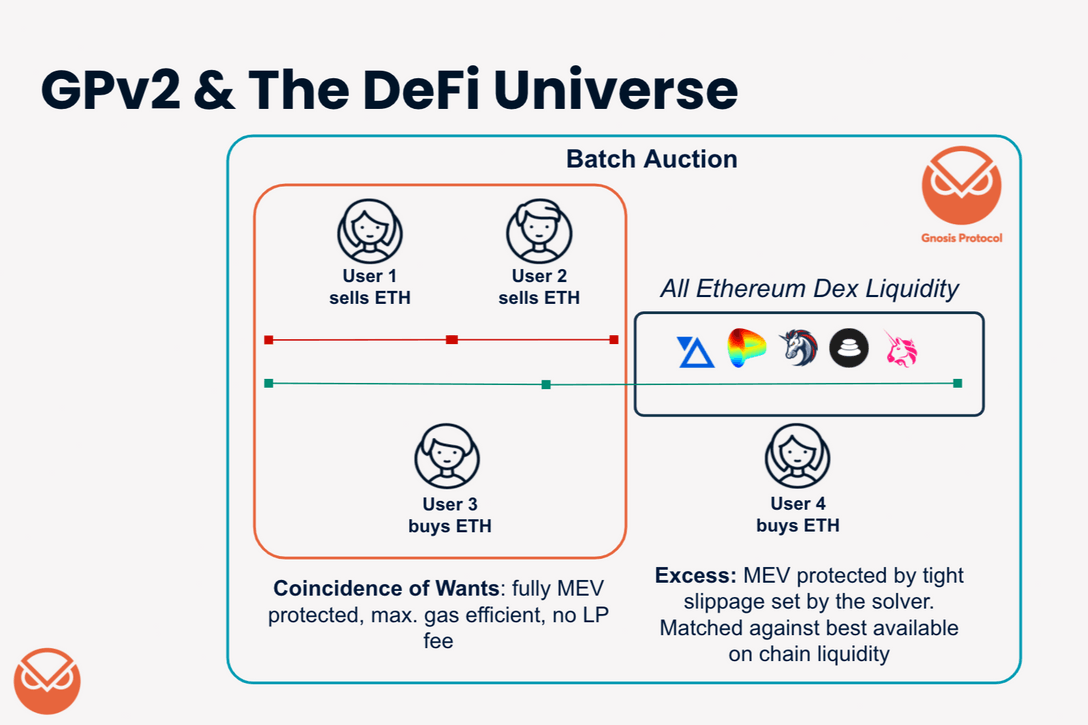

CowSwap leverages Coincidence of Wants (CoW): An economic wonder where two parties each hold an item the other wants, so they exchange these items directly.” If CoWs (Coincidence of Wants) orders exist in a batch, the “smaller” order is matched fully with the larger order. The excess of the larger order is settled with the best available base liquidity. The clearing price for both orders will be the price of the token with the excess amount on external liquidity sources to which the protocol is connected. Additionally, CowSwap can connect to all on-chain liquidity, when it does not have enough CoWs among the orders available for a batch, it taps other AMMs’ liquidity to be able to settle the traders’ orders.

As the DeFi sector continues to mature further we are starting to see the real contenders pull ahead. Also, clearer lines between platforms aimed at new investors and those aimed at long-term traders are starting to emerge. Arguably, differentiation in the decentralized exchange space has mostly come in the form of brand names and differing percentage gains. It is possible we are now starting to enter a phase where innovation, price sensitivity, and UX will be what sets each protocol apart.

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, MATIC, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet