What does ETH burnt rate actually mean?

One week since the Ethereum blockchain’s latest hard fork, the network has burned $100 million worth of ETH. Thanks to the implementation of EIP-1559, a proposal that burns a percentage of ETH from every transaction.

As Ethereum hit block 1,265,000 last week it pushed its London upgrade with the long-awaited Ethereum Improvement Proposal known as EIP-1559. Since that moment the news around Ethereum has focussed on the burnt rate of ETH in the immediate aftermath of the upgrade. A key metric in most people’s minds. In the first 2 days post-upgrade, Ethereum burned close to 9,200 ETH, approximately 0.01% of the total supply. Burning at a rate of 3.23 ETH per minute. Now, a lot of people are asking why is that important, and perhaps more importantly, how will it affect the price of ETH?

In this article, we will take a look at data from the Ethereum blockchain in the first 7 days after the London upgrade came into force. Focussing on burnt fees, gas prices, ETH inflation, transactions, and finally price. Moreover, the most anticipated part of the London upgrade was EIP-1559. The fee market change for the ETH 1.0 blockchain. The EIP essentially changed the algorithm tied to the base fee per gas in the protocol and it burns the base fee per gas. At the time of writing, more than $10,000 or 3.23 ETH is being burned through this mechanism every minute. The reason this excites Ethereum advocates and the wider community is a belief that this action will essentially make Ether a deflationary asset over time.

For decentralized applications, it potentially means a more stable and cost-effective network on which to operate and launch dapps. Additionally, a price rally for Ethereum could have a positive impact on dapps in certain sectors such as DeFi, NFTs, and play-to-earn games.

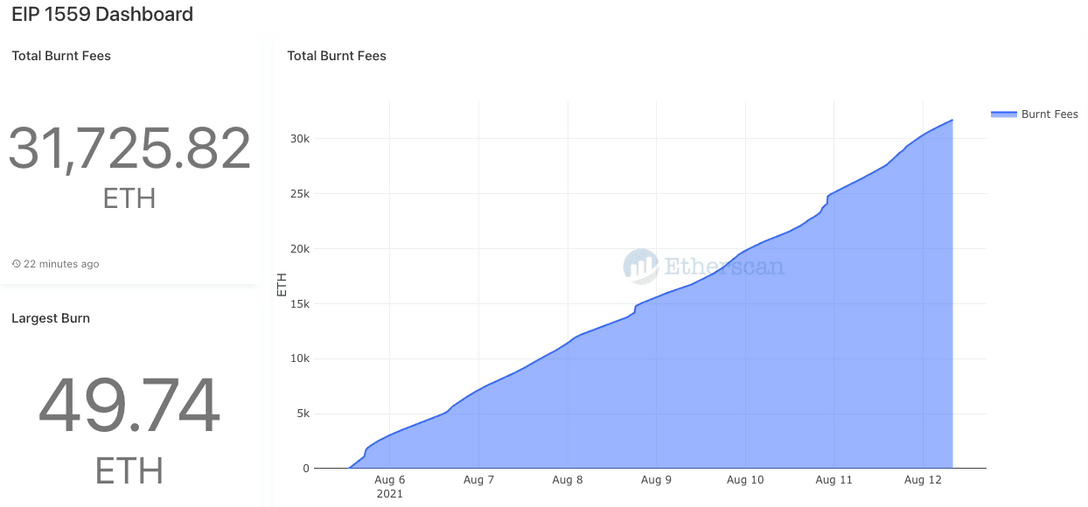

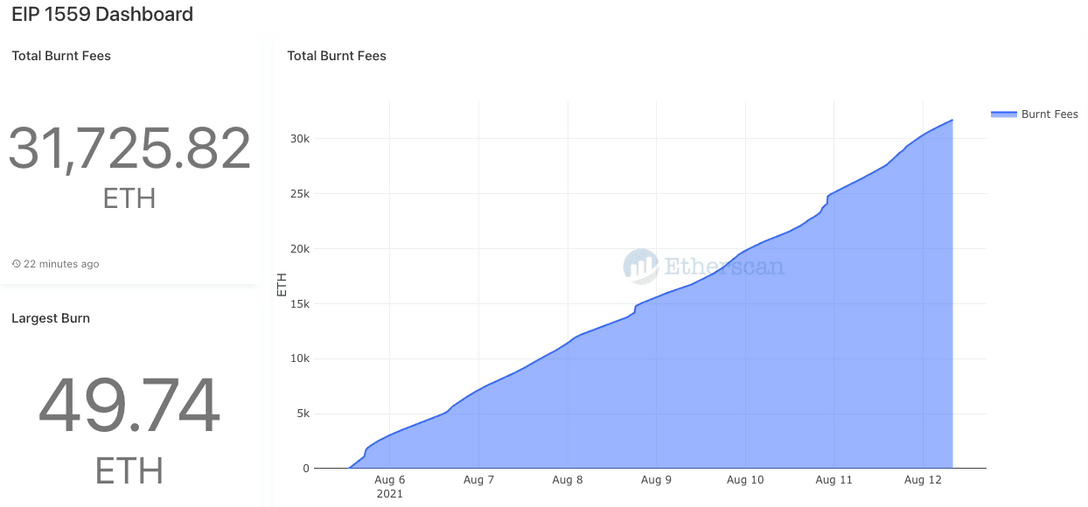

Burnt Fees

As mentioned, a key metric in most people’s minds is burnt fees. In the first 7 days post-London, Ethereum already burnt close to 32,000 ETH, approximately 0.17% of the total annual supply. It has burnt ETH at a rate of 3.23 ETH per minute with the largest burn being 49.74 ETH.

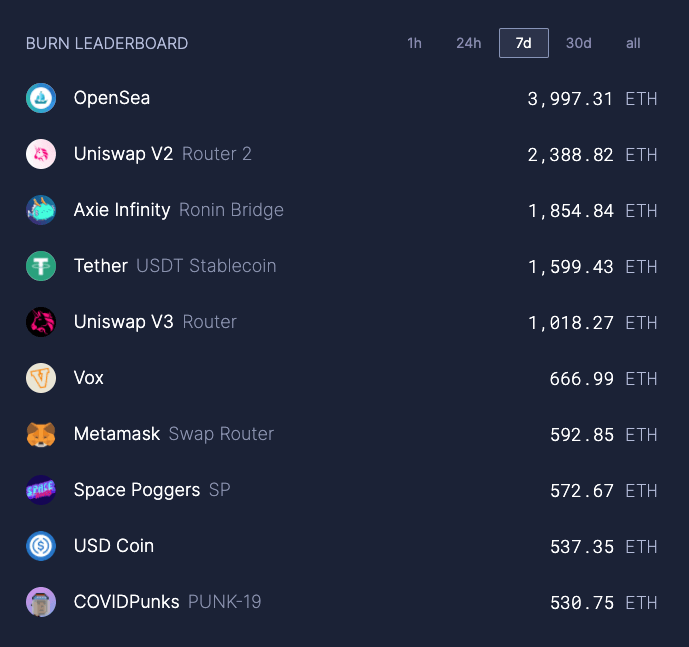

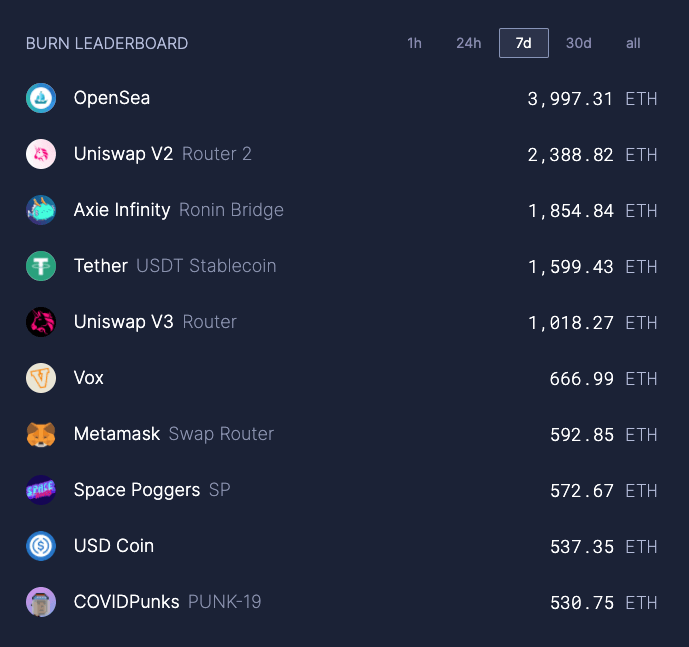

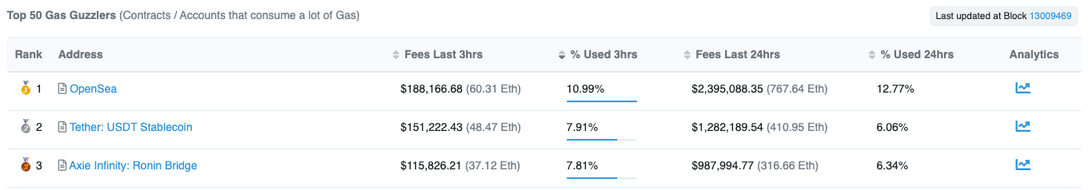

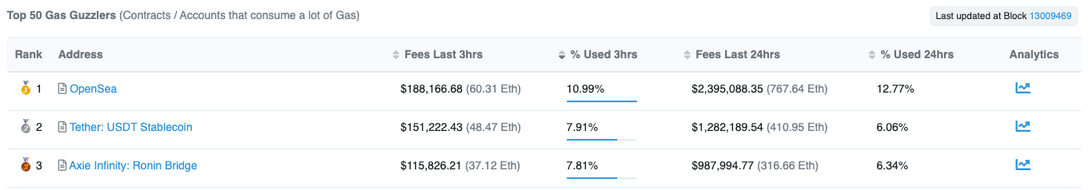

We name contracts that use the most gas due to the nature of the user’s actions as gas guzzlers. Importantly, post-upgrade, they are also the biggest burners of ETH. The top 10 gas-guzzlers burnt more than 13,000 ETH in the first 7 days since London.

Looking at the nature of the services offered by these contracts, we see that OpenSea and NFTs lead the way, followed very closely by Uniswap, a decentralized exchange (DEX). Perhaps surprisingly to some Axie Infinity is riding high in 3rd position having already burnt over 1.8k ETH. As seen, the top 5 addresses make up more than 80% of top gas guzzlers burning ETH and provide a solid understanding of what the Ethereum network is most widely used for right now. Interestingly the COVIDPunks NFTs have eaten up a lot of gas during the claim period which will now be looked at from the perspective of gas fee fluctuation as a result.

Additionally, gas spenders are entities that have spent and burnt the most gas. The leaders here are Binance and Coinbase. A deeper breakdown of the top 50 gas spenders can be found here.

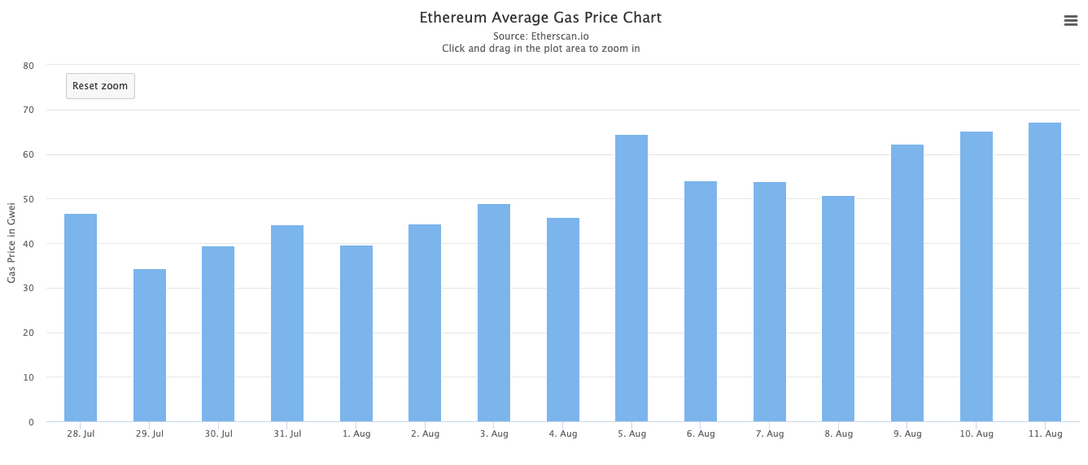

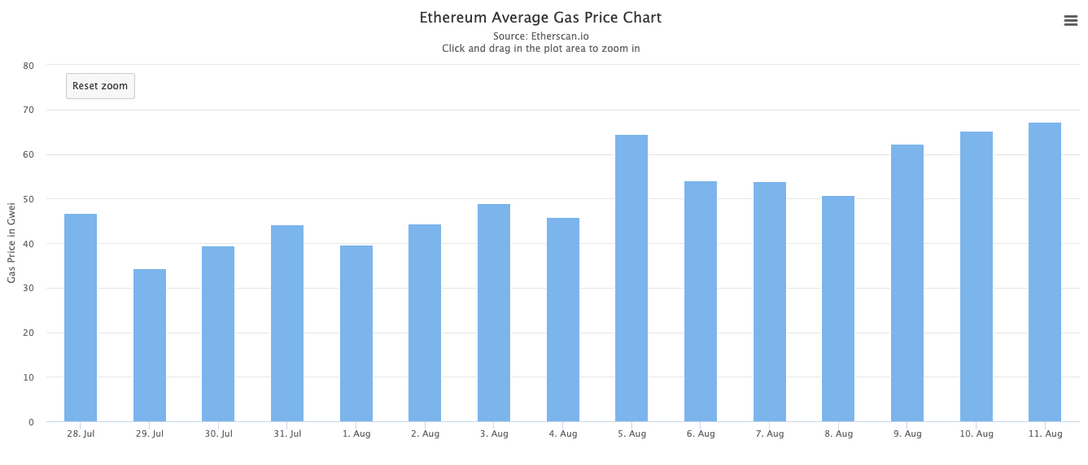

Gas Prices

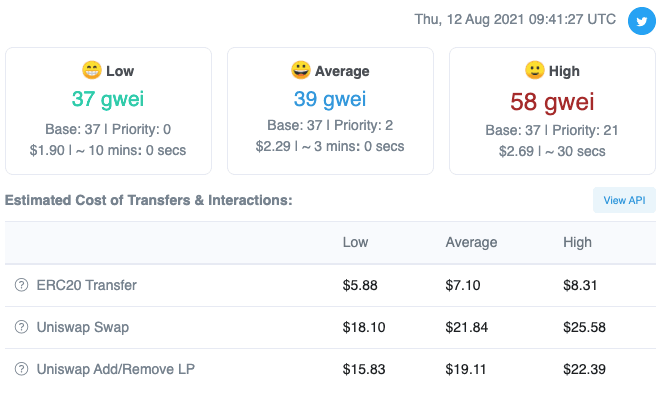

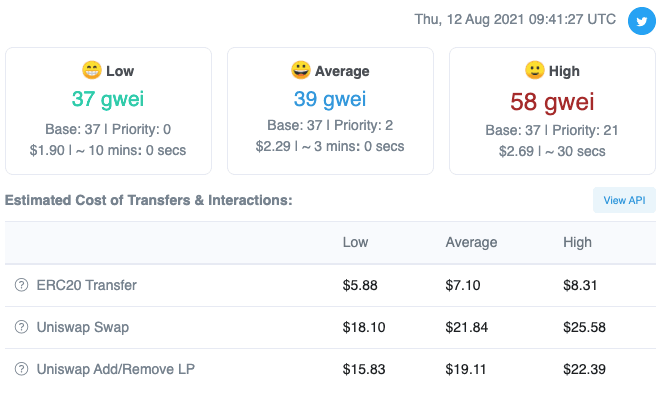

EIP–1559 changed the transaction mechanism in Ethereum. From a first-price auction to relying on a protocol base fee plus user-selected priority fee. As mentioned, the COVIDPunks NFT airdrop had a significant impact on the network’s base fees. In essence, becoming the first test case of the new EIP-1559 flexible block size mechanism.

Indeed, fees spiked quickly up and then back down on the 5th of August as users rushed to claim their NFTs. Interestingly we now see that gas fees have moved back up to those levels. Where they have settled and increased further for the past three days. Contrary to a popular belief, EIP-1559 will not necessarily result in lower gas fees. What it does provide is a better gas price estimation by updating protocol base fees.

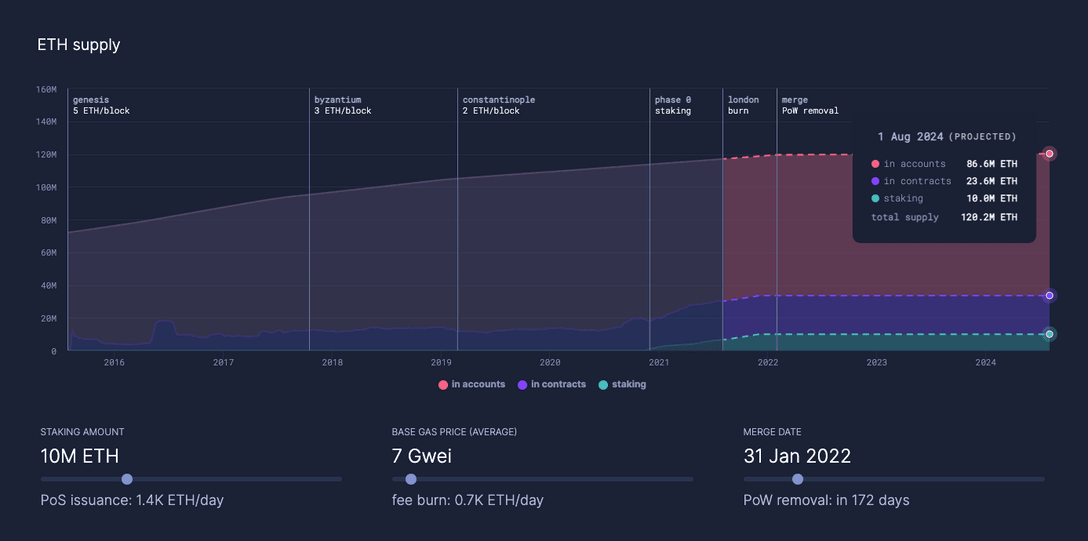

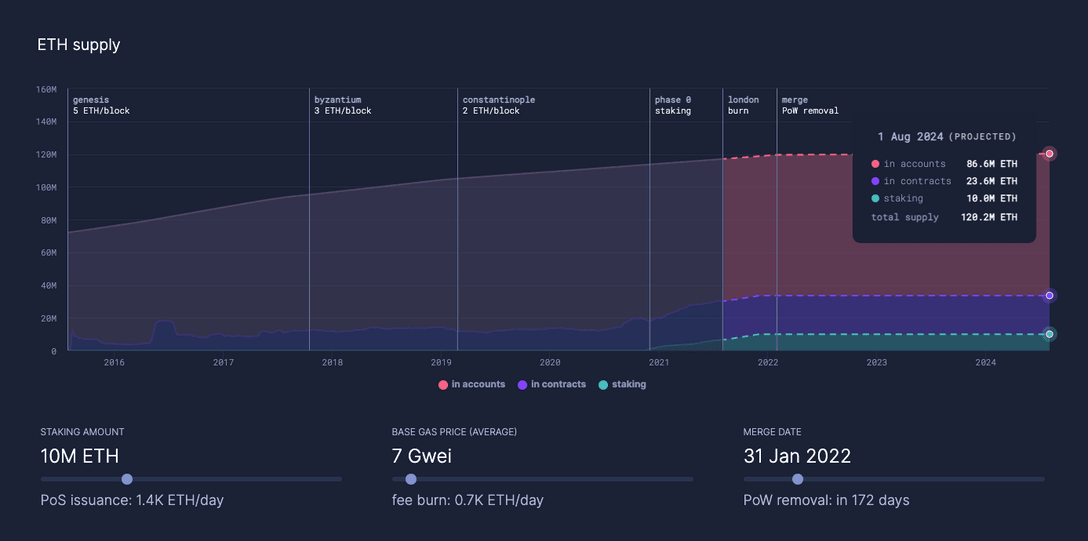

ETH Inflation

A further misconception is that EIP-1559 will result in a deflationary supply of ETH. Without the deployment of Proof-of-Stake (POS) and a subsequent drop in block rewards, Ethereum will overall remain inflationary. However, short periods with high base fees will result in a temporary deflation in ETH. Depending on the amounts of ETH staked after the merge to a Proof-of-Stake network and base fees, ETH supply may well become net deflationary.

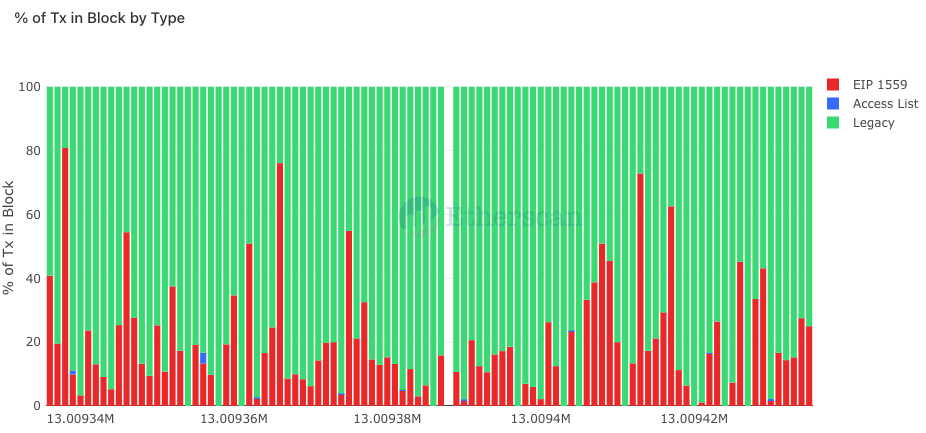

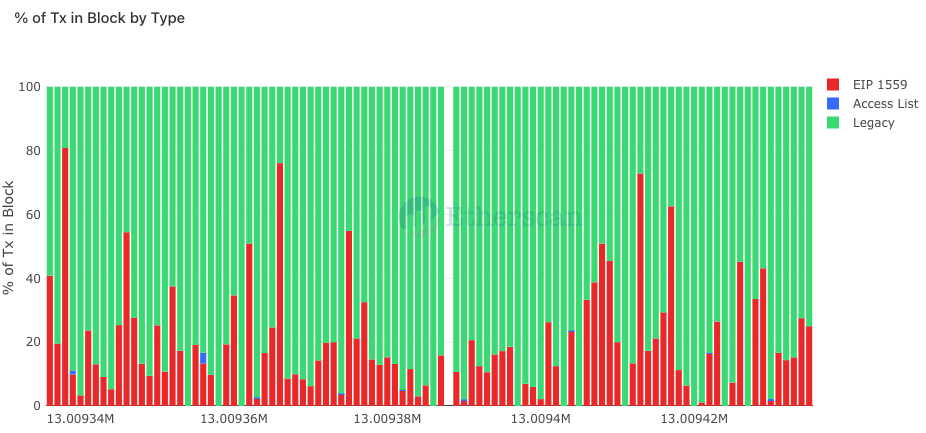

Transactions

Vitally at this point, most wallet providers have not switched to using EIP-1559-style transactions. Making up a small number of transactions so far. Importantly, using this transaction type saves ETH for the user and is expected to be widely adopted in the coming weeks and months. A comprehensive analysis of EIP-1559 will be more possible after the majority of transactions have changed from Legacy to EIP-1559.

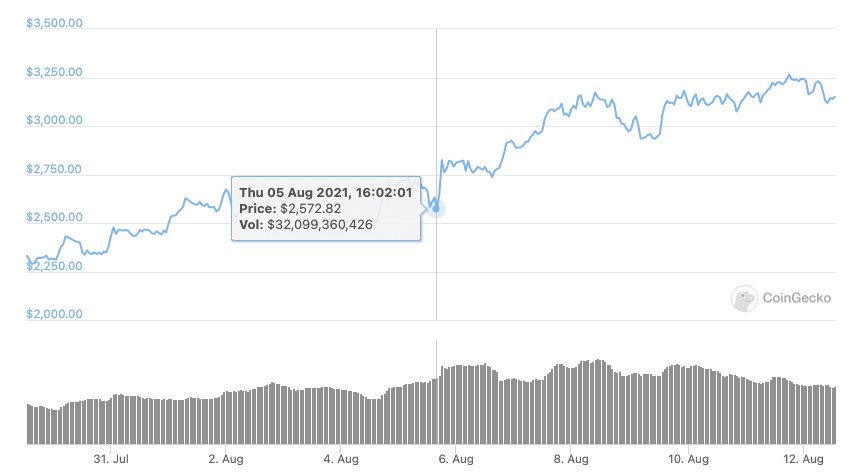

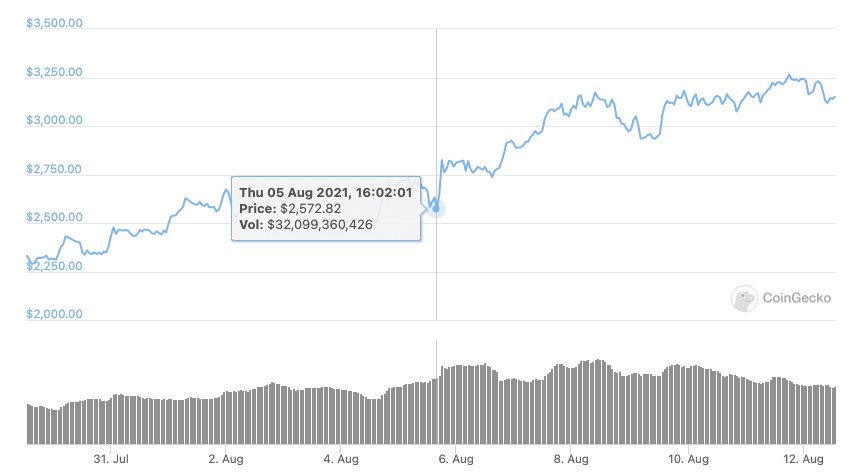

Ethereum Price

Finally, and perhaps most importantly to some, is what effect the upgrade had on the token price of Ethereum. In the last 7-days, the price of ETH has increased by 15.7% from $2,572 prior to the update, to $3,148 at the time of writing. Not surprising really as London has long been discussed as the most important change to the Ethereum Network in its 6-year life span.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet