Axie Infinity just crossed $25 million in daily volume, whilst selling more than 50,000 daily NFTs

Every day more than 350,000 players around the globe immerse themselves into the Axie digital universe. Using Pokemon-like dynamics, the blockchain game has reached massive popularity, especially since bridging to the Ronin sidechain. All in all, Axie Infinity has not become only a mainstream game, it is creating a new digital economy.

Learn everything you need to know about Axie Infinity in our guide. Visit the Axie Infinity dapp page for all the latest data, NFT sales and community tools.

Table of Contents

The rise of the Axies

Developed by Vietnamese studio Sky Mavis, Axie Infinity is a blockchain game where NFTs in the form of Axie monster pets, can be utilized to play in-game battles, breed new Axies, or collect game items that serve different purposes.

Axie Infinity has become the hottest project in the blockchain industry. In Dappradar’s Q2 Industry report, we already raised the attention towards the project’s massive success. Notably, this has happened predominantly since Axie moved to the Ronin sidechain. However, over the last 30 days, the game has registered around 350,000 daily active players. This means Axie is more than tripling the metric month-over-month.

Due to the high importance of NFTs within the game, there is a strong correlation between usage and NFT sales volumes. In the last 30 days, Axie has registered the second-highest number of NFT sales across all dapps with more than 887,000 sales just lagging NBA Top Shot.

Moreover, Axie has been responsible for over $372 million in sales during the last 30 days alone. Just as reference, premier NFT collections like CryptoPunks, BAYC or NBA Top Shot have amassed between $30 and $40 million each. On a daily basis, Axie is generating $25 million in volume by selling more than 50,000 NFTs.

The path to mass adoption

While the difference with the aforementioned NFT projects is overwhelming, what impresses even more is the exponential growth in the project’s demand. Compared to the numbers seen in June, Axie has increased 475% in sales volume. Additionally, that’s a whopping more than 800% when compared to Q1 numbers. The number of traders and sales have also increased exponentially. Axie registered a 304% and 290% increase from the previous 30 days respectively.

In depth analysis shows that together with the number of sales, demand for Axies keeps substantially growing as well. As of July 12, there were more than 454,000 Axie holders, which represents a 220% increase from the previous month. For the second straight month, there are more Axies bred than sold every day. Moreover, as Skirmantas Januškas -Dappradar’s CEO pointed out, “even with more Axies bred than sold every day, axie floor and average sale value keeps rising”.

Another interesting insight is that the buyers and sellers ratio has totally changed in the last months. Not long ago, at the start of May, the traders ratio was almost 1:1. It changed completely in the last two months where the buyers’ demand almost duplicated the existing supply. This is a powerful factor to consider in the mass adoption narrative.

Boostin’ digital channels

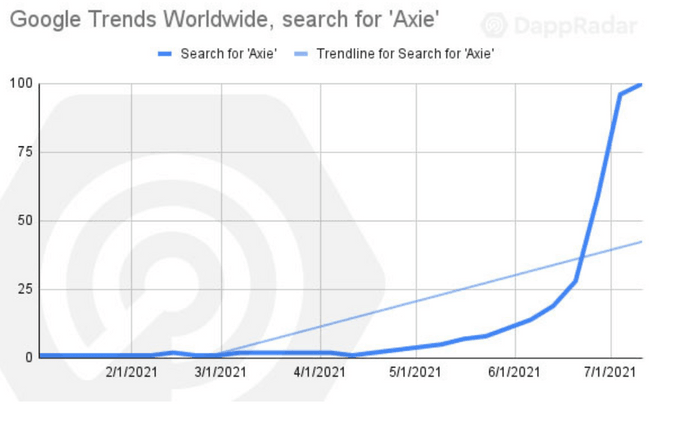

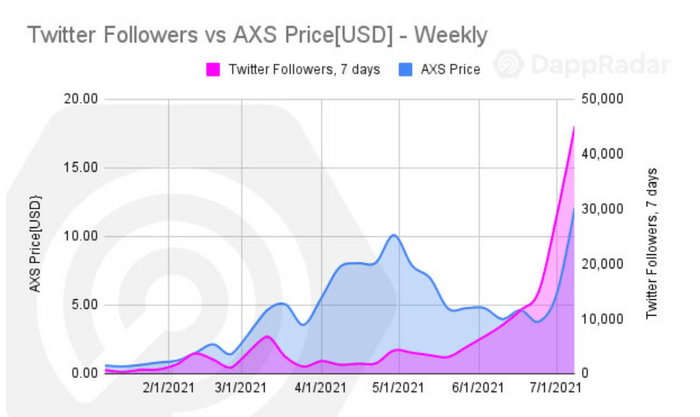

In-depth analysis has shown that the consumer’s preference for Axie Infinity has strongly grown. In addition, analysis performed on external data, in specific, social media, reflects the project’s impact in different channels, thus supporting the mass adoption thesis.

Axie Infinity currently has more than 215,000 followers on Twitter, a 135% increase from the previous month. Only in one day, from the 13th to the 14th of July, Axie’s Twitter account gained 23,000 followers.

Axie Infinity is managing to build a strong community across different platforms. As shown in the first image, Axie’s Discord membership has skyrocketed as well. This is a potentially strong signal of mass adoption.

Scholars, a new economic model

Axie Infinity has enjoyed massive success since migrating to Ronin. The launch of the sidechain has paved the way for a significant uptick in the game’s demand. As a result, according to Token Terminal, Axie Infinity has spawned over $69 million in revenue for the team during 2021 alone.

Nonetheless, something that is producing headlines around mainstream media, is the social impact generated from the game itself. Specifically, in emerging markets like the Philippines, where economic problems became more evident due to the pandemic, people found an income alternative as documented by Emfaris.

Players can earn SLP (Smooth love Potion), the in-game currency, by battling in PvE or PvP modes. This digital asset can later be used to breed new Axies, or to generate real life income by selling it for local currency through centralized exchanges.

However, not everybody has access to the popular game. Axie Infinity requires players to have at least three Axie pets to start earning SLP. Currently, the cheapest Axies found on the Axie Infinity Marketplace are worth around $350 with one breed or more than $400 for new eggs.

An initial investment of more than $1,000 is required, limiting the game access from an economical standpoint. Private initiatives like Blackpool Finance are adopting a business model commonly used for educational purposes to democratize the game’s access in a certain way.

This model can be related to widely known scholarships. Scholarships work as a shared revenue model where Axie owners “lend” their NFTs to players around the globe in order to enjoy the play-to-earn features. This type of model generates value in different ways. The social impact generated displays the potential of blockchain. On top of that, more people are getting to know this technology, improving their future outlook as well.

Scholarships are being offered to players from different countries, with the biggest numbers coming from Philippines, Venezuela, Cuba, Qatar and the United Arab Emirates. It will be worth monitoring in the upcoming months, the real impact achieved by Axie Infinity as a whole.

Tokenomics

Not only has Axie Infinity been the hottest project since May’s crypto crash, but AXS (Axie Infinity Shards), the Axie Infinity governance token has performed extremely well as of lately. Currently listed around $27 USD, AXS has increased a stunning 4,400% from the start of the year and almost 500% from the previous month.

AXS allows holders to participate in governance activities and grants them a vote within the Axie Community Treasury. Starting in 2021 players will be able to stake their AXS to earn weekly rewards.

On the other hand, there is the SLP token. As previously mentioned, SLP is a utility token that is minted within the game. It can be obtained by winning battles and is used to breed Axies. SLP’s price has increased 1,450% during this year, and is currently valued around $0.31.

Since breeding completely depends on the value of SLP, it will be interesting to monitor how representative the SLP price becomes in terms of the Axies’ population going forward.

To learn more about these two cryptos, I would recommend reading the AXS and SLP analysis.

Success extends to the Axie Marketplace

So far, most of Axie Infinity’s impact has been measured while considering the dapp as a game. However, the place where players get to trade Axies, game items, and virtual land has become relevant as the game itself. While Axies may be traded on different platforms, around 98% of the volume flows through its own marketplace.

The Axie Marketplace has become the leading marketplace in terms of volume and traders, surpassing top platforms like OpenSea and NBA Top Shot. During the last 30 days, Axie Marketplace generated more than $397 million in sales volume, a stunning 497% increase when comparing to the previous period.

While Axie Infinity Marketplace basically doubles OpenSea, the marketplace that hosts projects like CryptoPunks, Bored Apes, and Meebits, in terms of sales volume, there’s a significant difference in the number of traders.

Axie’s marketplace attracted more than 144,000 unique users in the last 30 days, more than triple when compared to the previous period. It is clear that the NFT space is generally growing, but Axie is outpacing the rest.

Mystical prices

Axie Infinity activity hevily correlates to Axie Marketplace activity. Each trader is performing 6.37 daily trades on average. It is clear that the sales volume is increasing significantly. However, perhaps more importantly, the value on average of the whole project is getting appreciated.

An exclusive edition of Axies called Mystic, and virtual lands that will be used for in-game activities, have been heavily appreciated too. Moreover, the floor price of Mystic Axies has surpassed CryptoPunks, seen by many as the golden standard for NFTs. The cheapest Mystic Axie on the Axie marketplace now costs 26.8 ETH or $50,920, whereas the cheapest CryptoPunk is being sold for 19,75 ETH or $37,640.

Moreover, on the week from the 5th to the 11th of July, 4 of the 6 top sales were Axie Infinity NFTs. It will be interesting to see just how far it can go and what other innovations the Axie team will add as we move through 2021. Axie collecting becomes even more interesting as it has an exclusive edition that might attract different types of investors.

Closing

A planet with almost 3 billion gamers and more than half billion unemployed people, may be the perfect storm for play-to-earn games like Axie Infinity. Migrating to Ronin had an enormous effect on the project. This migration enabled a true gaming experience with seamless and virtually costless transactions. Although Ronin is just Ethereum’s sidechain, it is more than fair to start viewing the network as a protocol on its own. During the last 30 days, Ronin generated more gas fees than BSC and MATIC. Only Uniswap produced more transaction fees on Ethereum’s Layer 1.

Moreover, cases in which a project has such a profound impact in people’s lives are very hard to find. It looks like people are beginning to understand the true potential behind blockchain and play-to-earn games like Axie.

The positive sentiment across multiple communities coming from the collateral social impact and the experience of belonging to the community itself, strengthens the argument for mass adoption. With Lunacia, Axie’s virtual land, expected to enable even more options in 2022, it seems like the virtual sky’s the limit for the project.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet