$2 billion worth of Bitcoin (BTC) options will expire on Friday, Aug. 27. Some analysts argue that a strong call (buy) option buying activity on Aug. 22 was likely the catalyst for the recent $50,000 price test.

Digital asset trading firm QCP Capital menționat in its market update that an entity has been “consistently pushing (option) prices higher in the last few weeks.” The activity, which took place during the morning trading session in Asia, aggressively bought bullish options in chunks of 100 BTC contracts each.

The report also mentions the exhaustion of regulatory concerns in the near term, as crypto-related decisions from the Senate Banking Committee and regulators are unlikely to bear fruits in 2021.

Bears might be analyzing different data

However, the most recent “The Week On Chain” report from blockchain analytics provider Glassnode included some concerning data from Bitcoin on-chain activity. Such analysis found that the amount of entity-adjusted transactions has not responded to the ongoing bullish action.

Moreover, Decentrader, a crypto market-intelligence provider, highlighted insufficient trading volume during this recent move to push BTC’s price above $52,000.

Friday will be an important test of the $50,000 level, as 4,372 BTC option contracts await the $218 million decision.

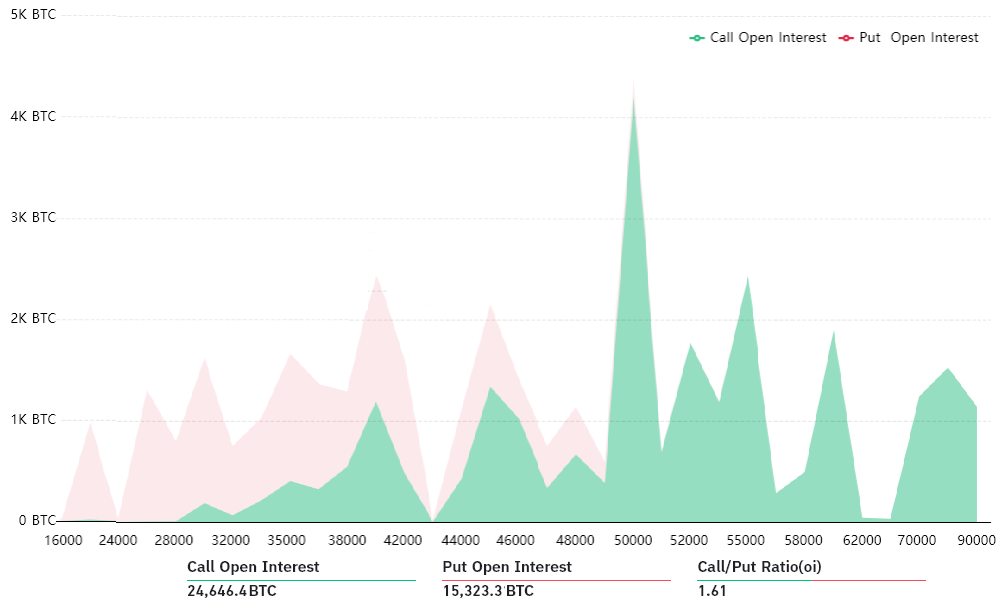

The initial call-to-put analysis shows the vast dominance of the neutral-to-bullish call instruments, with 60% larger open interest. Nevertheless, bulls might have been too optimistic, as 68% of their bets have been placed at $50,000 or higher.

Related: Bitcoin respinge 51 USD după ce Michael Saylor dezvăluie o nouă achiziție de BTC - Ce urmează?

91% of the put options will probably be worthless at expiry

On the other hand, 91% of the protective put options have been placed at $46,000 or below. Those neutral-to-bearish instruments will become worthless if Bitcoin trades above that price on Friday. The options expiry happens at 8:00 am UTC, so some additional volatility is expected ahead of the event.

Below are the four most likely scenarios, considering the current price levels. The imbalance favoring either side represents the potential profit from the expiry considering calls (buy) options are more frequently used in bullish strategies, whereas protective puts are used in neutral-to-bearish trades.

- Below $45,000: 4,040 calls vs. 2,500 puts. The net result is a $69 million advantage for the neutral-to-bullish instruments.

- Peste 46,000 USD: 6,500 calls vs. 1,300 puts. The net result is $239 million favoring the neutral-to-bullish instruments.

- Peste 48,000 USD: 7,400 calls vs. 420 puts. The net result is a $335 million advantage for neutral-to-bullish instruments.

- Peste 50,000 USD: 12,000 calls vs. 35 puts. The net result is a $600 million advantage for neutral-to-bullish instruments.

The above data shows how many contracts will be available on Friday, depending on the expiry price. There’s no way to measure the net result for every market participant as some investors could be trading more complex strategies, including market-neutral ones using both calls and protective puts.

Those two competing forces will show their strength as bears will try to minimize the damage. Either way, bulls have complete control of Friday’s expiry, and there seem to be enough incentives for them to defend the $48,000 level and even try a more significant gain by pushing the price above $50,000.

Meanwhile, bears should concentrate on the September expiry, although keeping in mind that El Salvador is expected to introduce Bitcoin as legal tender next month. In addition, the country is building the infrastructure to support a state-issued Bitcoin wallet called Chivo.

Opiniile și opiniile exprimate aici sunt doar cele ale autor și nu reflectă neapărat părerile lui Cointelegraph. Fiecare mișcare de investiții și tranzacționare implică risc. Ar trebui să efectuați propria cercetare atunci când luați o decizie.

- "

- 000

- 100

- 420

- Acțiune

- Suplimentar

- Avantaj

- analiză

- Google Analytics

- Asia

- activ

- Bancar

- Urșii

- Miliard

- Bitcoin

- Bitcoin Wallet

- blockchain

- BTC

- Clădire

- Bullish

- Bulls

- cumpăra

- Cumpărare

- apel

- capital

- Cointelegraph

- contracte

- cripto

- Curent

- de date

- eveniment

- Firmă

- Vineri

- nod de sticlă

- aici

- Evidențiat

- Cum

- HTTPS

- Inclusiv

- Infrastructură

- interes

- investiţie

- Investitori

- păstrare

- Legal

- Nivel

- Efectuarea

- Piață

- Actualizarea pieței

- măsura

- mediu

- menționează

- milion

- muta

- În apropiere

- net

- deschide

- Avize

- Opțiune

- Opţiuni

- Altele

- preţ

- Profit

- De protecţie

- cumpărare

- Autoritățile de reglementare

- raportează

- cercetare

- Risc

- Senat

- So

- a sustine

- test

- meserii

- Trading

- Actualizează

- Volatilitate

- Portofel

- săptămână

- valoare