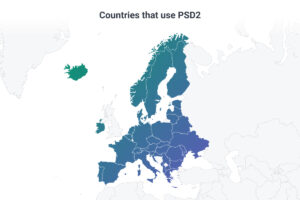

Inovația permite noi tipuri de plăți și creează un ecosistem cu adevărat dinamic. Cu toate acestea, pentru a crea o piață în care noi scheme, cum ar fi plățile cont la cont, pot concura, reglementarea trebuie să joace un rol central.

Modernizarea plăților este un subiect fierbinte în acest moment – și din motive întemeiate. Tehnologii și instrumente de plată digitale noi și inovatoare apar în mod constant, accentuând concurența în peisajul plăților.

The advent of open banking and Application Programming Interfaces (APIs) has unlocked access and connectivity options, creating links between banks, fintechs and platforms and enabling the direct flow of money from one account to another. Innovation has

paved the way for the rise of these account-to-account (A2A) payments, sharpening competition by introducing point of sale (POS) payments that no longer require credit card rails.

A2A payments have been around for a while in Sweden (Swish) and the Netherlands, where the iDEAL payments system was created in response to the growth of online shopping by a group of Dutch banks. Since then, iDEAL has emerged as a dominant payment system,

accelerating the uptake of real-time payments across the Netherlands and driving a surge that is only expected to grow in the coming years (Banking Frontiers, 2021). Elsewhere in Europe, the SEPA Credit Transfer (SCT) scheme enables the quick transfer of funds

from one account to another within the SEPA zone.

În ciuda succesului iDEAL și SCT, schemele de plată în timp real sunt încă relativ noi în restul Europei și în America de Nord. Deci, ce va fi nevoie pentru ca aceste scheme rapide, ieftine și versatile să transforme plățile în restul lumii?

Regulament.

Plățile A2A au potențialul de a detrona plățile bazate pe card și de a face ecosistemul și mai competitiv, dar numai dacă reglementarea ține pasul cu inovația și creează condițiile potrivite pentru ca concurența să înflorească.

In the simplest terms, credit card transactions and A2A payments are separated by the services that issuing banks offer their customers that other banks can’t or don’t: revolving credit, the ability to dispute transactions, and insurance against loss in

the event of fraud.

Yet these services are extended at a steep price, requiring merchants and customers to pay high interchange fees in exchange for the promise of security and reimbursement of fraudulent transactions. Without regulation of A2A payments schemes, non-issuing

banks simply won’t be able to offer the full range of services and guarantees—like security—that would allow them to compete with cards.

A2A payments are a much more efficient way to pay since the accounts settle in real time. In a truly competitive market, consumers would be able to access card-based payments and A2A payments for the same price. Friction would be removed, interchange fees

would decrease and A2A rails could provide infrastructure that enables even more new ways to pay using innovative technologies like QR codes and wallets.

In Europe, Strong Customer Authentication (SCA) serves as a helpful illustration of how regulatory action can support A2A payment schemes. Designed to reduce fraud and make online and contactless payments more secure, SCA requires that additional authentication

via two methods be built into checkout transactions. This means that a consumer must use at least two of the following: a password or pin, biometric identification, or hardware verification or a token. By requiring this additional layer of security, regulators

have inadvertently allowed A2A payments to compete with card-based payments by providing frictionless payment experiences that are still highly secure.

The United Kingdom understands the need for regulatory action and has undertaken two key initiatives to boost the use of A2A payments. The Treasury, Financial Conduct Authority (FCA) and the Payment Systems Regulatory (PSR) are creating a new regulatory

body to oversee open banking and A2A payments. The PSR and FCA are also proposing new regulations aimed at curbing fraud for introduction into parliament.

The EU is not far behind, promising regulatory action for real-time payments in the coming months. The European Central Bank has also urged the European Payments Council to accelerate the updating of existing instant payments using the SEPA Instant Credit

Transfer Scheme. Meanwhile, in the United States, the Federal Reserve is considering regulations to govern FedNow, its own RTP scheme.

Rămâne de văzut dacă oricare dintre aceste acțiuni de reglementare va fi suficientă pentru a oferi schemelor de plată A2A avansul necesar pentru a răsturna dominația cărților și a echita condițiile de joc. Să sperăm că da.

- furnică financiară

- blockchain

- conferința blockchain fintech

- chime fintech

- coinbase

- coingenius

- criptoconferință fintech

- FinTech

- aplicația fintech

- inovație fintech

- Fintextra

- Opensea

- PayPal

- Paytech

- payway

- Plato

- platoul ai

- Informații despre date Platon

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- fintech pătrat

- dungă

- tencent fintech

- Xero

- zephyrnet