Developments around the global regulation, hash rate and adoption of Bitcoin made for a unique year in 2021. So how will 2022 play out?

This past year was certainly a unique one for bitcoin. We saw the first bitcoin exchange-traded fund (ETF) get approved in the United States, the largest-ever Bitcoin conference in Miami, the much anticipated Taproot upgrade, all-time highs nearing $70,000, oh, and a nation state made bitcoin legal tender. Despite all this exciting news, some things never change — the FUD was as prevalent as ever. Bitcoin saw a variety of bans throughout 2021 and, to no one’s surprise, China stole the show in this regard.

Below is a list of bitcoin bans in 2021 alone:

- Turkey banned all bitcoin payments

- Nigeria a interzis tuturor instituțiilor reglementate (financiare și nefinanciare) să „trateze cu criptomonede sau să faciliteze plăți pentru schimburile de criptomonede”

- Iran banned the trading of bitcoin mined abroad și banned domestic bitcoin mining de asemenea (deși ultima măsură a fost ridicată înainte fiind reimpus)

- Ultimul, dar nu cel din urmă, China banned financial institutions and payments companies from offering bitcoin services; then it brought the hammer down on bitcoin mining

With 2021 nearly in the rearview mirror, I’ve been thinking a lot lately about what geopolitical bitcoin moves will occur throughout 2022. Below, I offer up a few questions to think about as we approach the new year:

- On a global scale, will we see bitcoin regulation turn friendly or grow increasingly hostile?

- Will hash rate continue to accumulate in the U.S. (possibly eclipsing a 50% share) or will we see a greater distribution moving forward?

- Will another country adopt bitcoin as legal tender? And if so, which one? There couldn’t be multiple throughout 2022, putea acolo?

Aceste întrebări se împart în trei categorii: rata de hash, reglementare și adoptare. Am abordat fiecare mai jos mai detaliat.

Regulament

If we step back and look at 2021 regulation on a global scale, would you think the overall trend was friendly or hostile? Even with the passing of El Salvador’s Bitcoin law, I’d say the global regulatory environment is still quite hostile toward Bitcoin. Iran, Turkey and Nigeria all made hostile moves in 2021. India si Statul New York considerată şi o acţiune de reglementare ostilă. Știm cu toții ce s-a întâmplat în China.

While the news of bans and corresponding FUD was prevalent, there is still a sense of optimism in the air. After the dust settled post-El Salvador’s bitcoin law, the obvious next question was: Who’s next? Many assumptions have been made about it being another Latin American country. This certainly makes sense.

Privind retrospectiv, El Salvador a fost aproape țara perfectă pentru a face acest salt uriaș. Este o națiune mică care a luptat din punct de vedere economic și nu are autonomie asupra monedei sale. Fiind o țară dolarizată, salvadorienii sunt supuși capriciului dolarului american și al Rezervei Federale. Nu voi dezbate dacă ruperea legăturilor cu colonul în 2001 a fost mișcarea corectă (Alex Gladstein a abordat bine acest subiect aici), but I certainly think taking a step toward a Bitcoin standard was.

El Salvador, ca multe țări din America Latină, este adesea afectat de politica externă a SUA și de intervenția Fondului Monetar Internațional (FMI). Efectul Cantillon creat de SUA a rănit oamenii din El Salvador prin umflarea monedei locale (și orice beneficii însoțite de această taxă ascunsă nu sunt văzute de salvadoreni), prin sancțiuni și controlul politicii comerciale. FMI dăunează populației din El Salvador, menținând țara îndatorată și degradându-i calitatea creditului pentru a asigura condiții nefavorabile pentru împrumuturile viitoare (sau chiar ținând ostatice perspectivele viitoare de creditare).

“El Salvador bond spreads to U.S. Treasuries hit a record high on Thursday on growing investor fears the Central American nation will not reach a potential $1 billion loan agreement with the International Monetary Fund and faces negative credit implications linked to its use of bitcoin.”

Deci, ce a făcut El Salvador în privința asta? S-a renunțat (deși nu complet). S-a făcut un pas în direcția suveranității financiare și un pas corespunzător departe de nefasta poliție a Statelor Unite și de tirania financiară a FMI. Dar El Salvador nu este singura țară dolarizată din America Latină care se luptă. Deci, o să întreb din nou, cine urmează?

Politicienii din America Latină au fost echipându-le ochii laser, starting to engage with the bitcoin community and proposing pro-bitcoin legislation. Little has materialized as of this writing (on the surface, at least), but we all know bitcoin acts “gradually, then suddenly.”

membru al congresului Carlitos Rejala din Paraguay, Deputatul mexican Eduardo Murat Hinojosa, Congresmanul panamez Gabriel Silva și Deputatul federal al Braziliei Aureo Ribeiro have all signaled support for bitcoin in one way or another.

It very well could be one of these countries that becomes the next Bitcoin hub, whether it be via a legal tender law or otherwise friendly regulation. And just maybe, we won’t be talking about another single country making bitcoin legal tender, but a handful when we look back at 2022.

Chiar dacă Predicția lui Alexander Höptner of five more developing countries adopting bitcoin as legal tender by the end of 2022 turns out to be accurate, there will still be FUD (there will mereu be FUD). We likely haven’t seen the last of Bitcoin bans and they may become more sophisticated and more strictly enforced as financial elites across the globe feel the increased pressure put upon them by this new freedom money.

„În realitate, atitudinea economică a Statelor Unite este vie și bine în regiune și a contribuit la stimularea condițiilor îngrozitoare care au declanșat recentul val de revolte.”

-Alexandru Main, director de politică internațională la Centrul pentru Cercetare Economică și Politică, despre protestele recente din America Latină

Rata de spălare

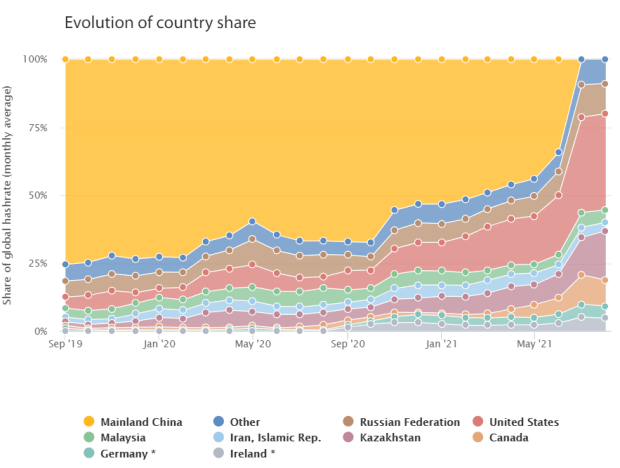

În toamna lui 2019, China continentală a controlat approximately 75% of the global Bitcoin hash rate. Acest număr a scăzut, dar a fost încă peste 50% când am început 2021. Acum, în primele zile ale anului 2022, acesta sta la 0%.

This was one of the best stories in bitcoin in 2021. Sure, the FUDsters were sounding the alarm when China banned bitcoin mining this past summer, but that was to be expected and they failed to zoom out. China enacting a legitimate and all-out ban on bitcoin mining certainly hurt the overall hash rate at the time, so the price dropped accordingly. Alarms were sounded. Articles were written. The death of bitcoin was yet again declared.

Not so fast. Many bitcoiners knew this would actually be un lucru bun. Poate că nu a fost evident din exterior privind înăuntru, dar a fost limpede ca ziua pentru cei care îl înțeleg. A mass exodus of bitcoin mining from China would result in a greater distribution of global hash rate. This is a huge deal. Not to mention that this does away with one of the most prominent anti-bitcoin arguments — that China has too much control of Bitcoin infrastructure or might co-opt the network by a hostile miner takeover.

După cum este evident în imaginea de mai jos, multe țări au beneficiat de interzicerea exploatării miniere din China: Rusia, Kazahstan și Statele Unite ale Americii, printre ele. SUA au început anul cu o cotă de aproximativ 11% din rata hash globală. Acest număr (din august, conform celor mai recente date disponibile) este de 35%. Care sunt șansele ca acest număr să continue să crească? Când trece de la ceva de sărbătorit la un punct de îngrijorare?

Ca american, m-am bucurat să văd mineri venind în SUA. Cu toate acestea, făcând un pas înapoi și recunoscând cât de repede SUA și-a triplat rata de hash, cred că există un motiv de îngrijorare. Nu aș vrea ca nicio țară să revendice tronul eliberat al Chinei de jucător dominant în rata hash globală. Este posibil ca 75% din rata de hash din SUA să fie de fapt mai proastă decât atunci când aceeași concentrație era în China?

SUA ar putea fi în spatele UE în ceea ce privește reglementarea sustenabilității, dar pare să intenționeze să reducă rapid acest decalaj. Cu atât de multe corporații care se înclină spre ESG, subiectul ESG and Bitcoin is certainly not going anywhere. This would call into question bitcoin’s fungibility if “green bitcoin” were to be priced at a premium. It would also be in direct conflict with the free market ethos that Bitcoin naturally promotes.

While the Chinese regulatory environment was uncertain and oftentimes really harsh toward bitcoin, it ultimately decided to push miners out as opposed to co-opting them. Since miners benefit from economies of scale, they’ll likely trend toward centralization over time. This makes regulatory capture more of a concern, whether it be in China, the U.S. or another other country. The next time a major geopolitical move is taken by a global mining power, it might take the form of state control rather than a ban. Even though El Salvador mining bitcoin with geothermal energy is undoubtedly really cool, state-owned bitcoin mining facilities is not a trend I want to see emerge.

This might be a bit farther out than 2022. It might be unrealistic altogether. Maybe it’s even one of those chances bitcoiners would be willing to take, as it might not arise until we’re at or near hyperbitcoinization. Still, it’s worth some consideration as we look ahead to the short- and long-term futures of bitcoin.

Adoptare

Bitcoin adoption has exploded over the years and is now estimat a fi la nord de 100 de milioane de utilizatori. Bitcoin users include institutional and retail investors, humanitarians, bankers, government officials, large and small businesses, refugees and everyone in between. Even if we were to say “that 100 million seems really low” and infer it might be closer to double that, we’d only be at roughly 4% to 5% of adults owning bitcoin globally. Este comparabil cu internetul din 1999.

If we continue the trends seen in Bitcoin adoption over the past couple years, the number of global users will reach one billion sooner than we know it. Trying to predict what will happen to bitcoin’s price, hash rate or adoption in the short term is a fool’s errand, but we can say with near certainty that Bitcoin’s user base will expand over longer periods of time.

Este imposibil să știi cu exactitate câți utilizatori există, dar mai jos sunt câteva tendințe care ilustrează clar modul în care adoptarea crește rapid:

- Șase la sută dintre investitorii americani (defined as those with $10,000 invested in stocks, bonds or mutual funds) say they own bitcoin, up from 2% in 2018.

- Institutional investors are beginning to favor bitcoin over gold.

- Bitcoin’s use for everyday savings, peer-to-peer transactions and remittance payments is becoming more prevalent in the places that need it most (for example, adoption shot up 1,200% de la an la an în Africa).

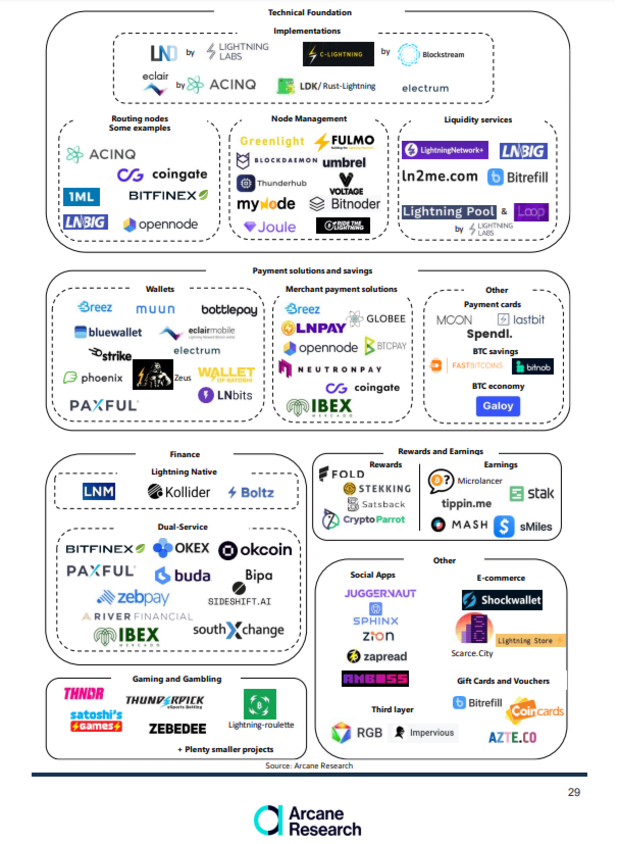

The final bullet point above goes hand in hand with the growth of the Lightning Network. This has been my personal favorite trend in Bitcoin adoption this year. Nation state and institutional adoption will certainly have a greater upward pull on bitcoin’s price, but the Lightning Network is how we onboard millions and eventually billions around the globe, enabling near-instant and zero-cost micropayments. The Lightning Network has more than tripled in capacity this year and the below image shows just how robust development is within the Lightning ecosystem.

The velocity with which Bitcoin is adopted by the average person may have less impact on the price compared to when whales make big splashes, but it is a signal that needs to be closely monitored. The President of El Salvador cited bitcoin’s adoption in Bitcoin Beach as a use case for the country’s legal tender law. Regulation and adoption go hand-in-hand, and often it is assumed that regulation will impact adoption, and not the other way around. That statement might sound logical, but bitcoin has been known to challenge our assumptions.

Places like Nigeria, Pakistan, India and China have all been quite hostile toward Bitcoin and yet, their citizens are among the most prevalent users. Why is that? That’s because bitcoin is freedom money. The nevoie for bitcoin in each of those countries is higher than that in the West.

Bitcoin is not just number go up (in monetary terms) technology, it is adoption go up technology. I’ve heard the phrase “bitcoin is inevitable” frequently used within the community. I’m not one to take things for granted, but that is a statement I agree with given a long enough time horizon. If I game out polar scenarios, one with favorable and one with unfavorable regulation, I end up at the same result of increased adoption.

Mulți indivizi și chiar mai multe instituții au nevoie de reglementări prietenoase pentru a se integra, în timp ce tirania financiară, inflația extremă și represiunea societală îi vor forța pe cei lipsiți de drepturi să renunțe la sistemul lor monetar actual.

Closing out this point with one of my big questions for 2022: Will bitcoin adoption explode this upcoming year? Or will it go up at a more controlled pace?

I highly doubt I’ll be looking back at 2022 a year from now and be writing an article about how the number of global bitcoin users actually went jos de cand am scris aceasta piesa. Ceea ce voi căuta în schimb este că anumite piese de domino care împing rata de adopție la ceva ce nu am mai văzut până acum.

Încheierea

Deși am abordat separat rata de hash, adopția și reglementarea în acest articol, cu siguranță nu pot fi separate în viața reală. Fiecare dintre aceste trei idei este inerent legată.

I’m incredibly bullish on bitcoin looking ahead to 2022 and even more so as we look farther out. That doesn’t mean we don’t have anything to be weary of and that doesn’t mean that there isn’t a lot of work left to do, people to onboard, and FUD to fight, but I remain as optimistic as ever. My hope is that 2022 is another great year for Bitcoin and that one year from today I can pen a similar piece as we head into 2023.

Aceasta este o postare invitată de Nick Fonseca. Opiniile exprimate sunt în întregime proprii și nu reflectă neapărat cele ale BTC Inc sau Revista Bitcoin.

Source: https://bitcoinmagazine.com/culture/how-geopolitics-will-shape-bitcoin-in-2022

- "

- 000

- 100

- 2019

- Acțiune

- Adoptare

- Acord

- alex

- TOATE

- America

- american

- printre

- argumente

- în jurul

- articol

- bunuri

- August

- Interzice

- banurile

- CEL MAI BUN

- Miliard

- Pic

- Bitcoin

- adoptarea bitcoin

- Bitcoin miniere

- Regularea Bitcoin

- bitcoineri

- blockchain

- Bloomberg

- bord

- Obligațiuni

- BTC

- BTC Inc.

- Bullish

- întreprinderi

- apel

- Capacitate

- Provoca

- contesta

- șansele

- Schimbare

- şef

- China

- chinez

- mai aproape

- venire

- comunitate

- Companii

- concentrare

- Conferință

- conflict

- continua

- continuă

- Corporații

- țări

- Cuplu

- credit

- cripto

- criptomonede

- cryptocurrency

- Moneda

- Monedă

- Curent

- de date

- zi

- afacere

- dezbatere

- detaliu

- Dezvoltare

- FĂCUT

- Director

- Dolar

- scăzut

- Devreme

- Economic

- ecosistem

- Mediu inconjurator

- ETF

- Ethos

- EU

- Exod

- Extinde

- fete

- FAST

- temeri

- federal

- Federal Reserve

- financiar

- Institutii financiare

- First

- formă

- Înainte

- Gratuit

- Libertate

- fond

- Fondurile

- viitor

- Futures

- joc

- decalaj

- Caritate

- La nivel global

- bine

- Guvern

- mare

- Crește

- În creştere

- Creștere

- Oaspete

- Vizitator Mesaj

- hașiș

- hash rate

- cap

- Înalt

- Cum

- HTTPS

- mare

- imagine

- FMI

- Impactul

- India

- inflaţiei

- Infrastructură

- Instituţional

- Adopție instituțională

- instituții

- scop

- Internațional

- Fondul Monetar Internațional

- Internet

- investitor

- Investitori

- Iran

- IT

- păstrare

- mare

- America Latina

- America Latină

- Drept

- Legal

- Legislație

- împrumut

- fulger

- Rețeaua de fulgere

- Listă

- Credite

- local

- Lung

- major

- Efectuarea

- Piață

- măsura

- microplati

- milion

- minerii

- Minerit

- oglindă

- bani

- muta

- În apropiere

- reţea

- Anul Nou

- ştiri

- Nigeria

- North

- oferi

- oferind

- Avize

- Altele

- Paraguay

- plăți

- oameni

- Joaca

- player

- Politica

- putere

- Premium

- preşedinte

- presiune

- preţ

- Protestele

- calitate

- Realitate

- refugiaţi

- Regulament

- autoritățile de reglementare

- remitere

- cercetare

- cu amănuntul

- Investitori de vânzare cu amănuntul

- Reuters

- Rusia

- sancţiuni

- Scară

- sens

- Servicii

- Distribuie

- Pantaloni scurți

- mic

- întreprinderile mici

- So

- început

- Stat

- Declarație

- Statele

- Stocuri

- furat

- Istorii

- de vară

- a sustine

- Suprafață

- surpriză

- Durabilitate

- sistem

- vorbesc

- impozit

- Tehnologia

- Gândire

- timp

- comerţului

- Trading

- Tranzacții

- Tendinţe

- Turcia

- stare de nervozitate

- ne

- Unit

- Statele Unite

- utilizatorii

- Viteză

- Val

- Vest

- OMS

- în

- Apartamente

- valoare

- scris

- Yahoo

- an

- ani

- zoom