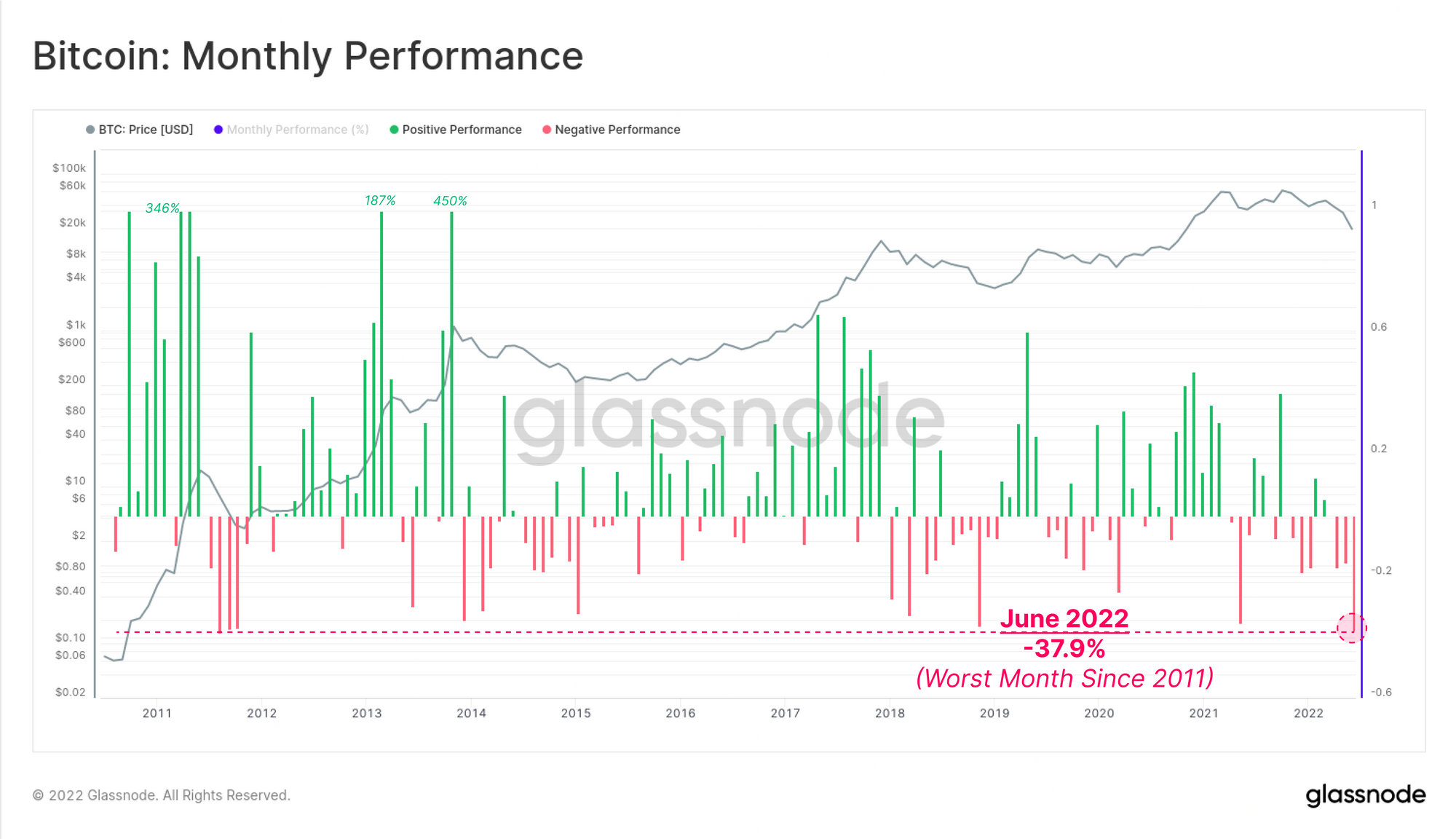

Pe măsură ce prima jumătate a anului 2022 se apropie de sfârșit, Bitcoin a înregistrat una dintre cele mai proaste performanțe lunare ale prețurilor din istorie. Prețurile s-au tranzacționat cu -37.9% în ultimele 30 de zile, concurând doar cu piața urs din 2011, pentru coroana celei mai proaste luni înregistrate. Pentru un sentiment de amploare, prețurile BTC au fost sub 10 USD în 2011.

Prețurile Bitcoin s-au consolidat în această săptămână, digerând pierderile lunii și menținând un interval de tranzacționare constant în jurul maximului istoric de 2017 USD din 20. Piața s-a deschis la un maxim la 21,471 dolari, s-a tranzacționat în scădere la un scurt minim la jumătatea săptămânii de 18,741 dolari, înainte de a crește până la 19,139 dolari.

Cu noi estimări ale inflației pentru iunie rămânând ridicate și nori de furtună cu potențial recesiune care se profilează, piața rămâne cu riscuri puternice. Acest lucru este evident în performanța și activitatea în lanț a Bitcoin, care s-a redus modest în ultimele săptămâni. Având în vedere că activitatea rețelei este acum la niveluri care coincid cu cea mai profundă fază de urs din 2018 și 2019, se pare că a avut loc o epurare aproape completă a turismului de piață.

Activitatea care rămâne însă pare să se alinieze cu o tendință constantă de acumulare ridicată de convingeri și auto-custodie. Soldurile valutare se epuizează la niveluri istorice ridicate, iar soldurile de creveți și balene cresc semnificativ.

Cu forțele de piață atât de complexe și probabil divergente, în această ediție, vom încerca să identificăm tendințele cheie care apar în performanța în lanț și distribuția aprovizionării pentru Bitcoin.

Traduceri

Această săptămână On-chain este acum tradusă în Spaniolă, Italiană, Chineză, Japonez, Turcă, Franceză, Portugheză, Farsi, Poloneză, ebraică și Greacă.

Tabloul de bord Week Onchain

Buletinul informativ Week Onchain are un tablou de bord live cu toate graficele prezentate