Dette er en meningsredaktion af Andrew Keir, an author of a daily newsletter, where he dives deeply into the transformational nature of Bitcoin.

Denne artikel er inspireret af et tweet fra Guy Swann, "At få ting gratis koster en formue", hvilket præcist opsummerer situationen under et fiat-monetært system: et system, der giver mulighed for den endeløse forøgelse af de monetære enheder ved hånden af et lille, mafia-lignende kartel, og kl. bekostning af resten.

Denne dynamik minder mig om et andet citat fra Jeff Booth det er noget i retning af,

”Overflod af penge fører til knaphed alle andre steder. Mangel på penge fører til overflod alle andre steder."

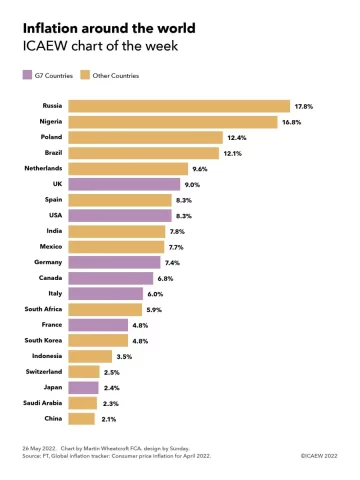

Ligesom hvad der skete med romerne, da de uansvarligt pustede op denar, det samme sker lige nu med den amerikanske dollar og hver anden fiat-shitcoin, der findes. Den skade, det gør for at splitte samfundet fra hinanden, vil blive studeret af historikere i de kommende år.

It’s so counterintuitive. Most people have no understanding of money or the monetary system and they just blindly trust the lunatics in government. They have no idea that the ability to give out stimulus checks and just hand out money with bailouts is actually the very thing that is harming them most. It’s distorting all natural incentives provided by a free-market dynamic and creating dire unwanted externalities which create alternate incentives that are much, much worse than what would be output otherwise if the market were simply allowed to do what it does best, which is solve myriad complexity in the most supreme way we know how.

Denne forvrængning af incitamenter korrumperer os dybt fra et psykologisk synspunkt, og den korrumperer vores værdistruktur, hvorigennem al information flyder, når vi træffer beslutninger og forsøger at orientere os i verden.

Den mest åbenlyse manifestation af dette er kinetisk krig. Der er langt mindre indlysende eksempler, selvom du ikke behøver at kigge hårdt for at se dem. To ting skete i denne uge i USA, som er eksempler på denne forstyrrelse, vi oplever.

The FBI Raided The Home Of Former U.S. President Donald Trump.

The raiding of a former president’s house is absolutely obscene and should give you chills. I’ll be the first to admit I don’t know all the details. I’m not sure anyone really does at this point, but It has some spooky John F. Kennedy vibes about it, and it looks to be a deeply political act at its core, further highlighting how far the U.S. establishment has fallen and how far it has drifted from having any kind of moral compass.

Det amerikanske finansministerium sanktionerede et stykke software kaldet Tornado Cash

Jeg bekymrer mig lidt om Ethereum, men sanktionering open source-software er noget uden fortilfælde. Det er ikke en person eller en forretningsenhed; det er simpelthen information på et grundlæggende niveau. Oplysninger kan ikke sanktioneres. Det kan ikke opfordres til at gå rettens vej. Dette er rettet mod privatlivssøgende amerikanere - dem alle. Implikationerne af dette har hidtil været mange: indefrysning af midler fra centraliserede og regulerede enheder, og Tornado Cashs grundlægger har fået sit github-lager suspenderet, hvilket simpelthen er censur af information, af kode. Desværre er det sandsynligt, at det værste stadig venter.

Mit vigtigste bud på dette er, at den amerikanske regering lige har sat deres borgere på varsel. De mener ikke, at du har ret til privatliv. De ønsker at behandle privatlivet, som om det er noget kriminelt og uhyggeligt. Dette er et direkte angreb på amerikanske borgere, men det er usandsynligt, at denne holdning er begrænset til USA. Det virker meget sandsynligt, at mange andre mindre "allierede" vil følge trop og komme i kø.

Hvad betyder det for Bitcoin?

Det viser endnu en gang det niveau, staten vil gå til for at beholde dig som en underordnet slave. Hvis kode er tale, så viser dette en fuldstændig tilsidesættelse af enhver frihed, og det er en iøjnefaldende påmindelse om behovet for ægte decentralisering og den kritiske karakter af selvforsorg.

Decentralisering giver os mulighed for at fjerne enkelte fejlpunkter, såsom udvekslinger. Børser er regulerede enheder, og som vi ser i dette tilfælde, vil de øjeblikkeligt bøje knæet. De vil gøre, hvad de får besked på.

If you opt to use bitcoin in such a way where you allocate trust to an exchange to take custody of your bitcoin, it is important you understand the risk you are taking. The reality is, that bitcoin is no longer yours. All you have is an IOU, and under extreme adversarial conditions, as with this current example, that IOU will not be redeemable for your bitcoin. What could have been fuck-you money, will become fuck-me money.

I can’t speak to the properties of shitcoin mixing services like the one in question, but bitcoin mixing can imply a custodial service. One where you relinquish custody of your bitcoin. If you use a mixing service, you are sending your bitcoin to a third party and hoping to receive someone else’s bitcoin back. CoinJoins on the other hand are collaborative transactions which leverage the core properties of the Bitcoin protocol — that being self-custody — to provide you with a powerful tool to improve your privacy while not compromising the trust model which Bitcoin affords.

Enhver enhed, der er centraliseret - hvad enten det er en forvaringsblandingstjeneste eller en hvilken som helst anden - er et enkelt fejlpunkt og bør undgås. Stol på disse på din fare.

The question remains: If open-source software can be sanctioned, can Bitcoin be sanctioned, given that it is simply free, open-source software, too?

As mentioned above, open-source software cannot really be sanctioned. Can people using certain software be targeted? While the notion of such a thing seems completely insane, the answer of course is yes, but it becomes more a question of how can that be enforced. If the U.S. Treasury said tomorrow Bitcoin is sanctioned, what they are really saying is you are sanctioned from using Bitcoin. They would be criminalizing the transmission of scarce information. Despite how absurd that sounds, it’s worth considering the possibility given this recent development.

In this instance, any bitcoin custodied by regulated third parties vanishes and would be under the control of the government. That is the most obvious point of capture. Any single points of failure become targets. Assume failure. Even with that, Bitcoin would remain. The network would continue to produce blocks and facilitate transactions, which highlights the critical nature of running a node. If there were only a few nodes, then the potential may exist to capture and shut down the network, but there are tens of thousands of nodes and this number is growing every day. In addition, the nodes are geographically distributed throughout every corner of the planet. The realistic probability of shutting down every one of those, while it is not zero, would likely be close to it.

The Bitcoin network would endure such attacks and, ultimately, it would become stronger. But how individuals use bitcoin would have significant ramifications on individual Bitcoiners. Which brings us back to the critical nature of privacy: If you have a high level of privacy, you cannot be targeted as easily. If the majority of users have a high level of privacy, such an action becomes almost unenforceable. A powerful asymmetry would exist and render any attempts to sanction or outlaw it as futile.

Der er 437,000,000 nye grunde to ensure you custody the keys to your bitcoin, and there are many future Bitcoiners learning this lesson the hard way right now.

Bitcoin was designed to operate under adversarial conditions. There is little the government can do to attack the Bitcoin protocol, which makes it unlikely they would try. They would simply attack the users: us. Acknowledge the game board and act accordingly. Privacy is not just a right, it is critical. Everything is downstream of privacy and it is a central piece of the fortune you pay for getting things for free.

Remember: Freedom is not given, it is taken. Bitcoin empowers you to take yours.

Reparer pengene, fix verden.

Dette er et gæsteindlæg af Andrew Keir. Udtalte meninger er helt deres egne og afspejler ikke nødvendigvis dem fra BTC Inc. eller Bitcoin Magazine.

- Bitcoin

- Bitcoin Magazine

- blockchain

- overholdelse af blockchain

- blockchain konference

- coinbase

- coingenius

- Konsensus

- Omkostninger

- kryptokonference

- krypto minedrift

- cryptocurrency

- Medarbejder kultur

- decentral

- Defi

- Digitale aktiver

- ethereum

- FBI

- fyr swann

- jeff bod

- machine learning

- Blanding

- ikke fungibelt symbol

- Udtalelse

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- bevis for indsatsen

- W3

- zephyrnet