This is an opinion editorial by Justin Ehrenhofer, the vice president of operations and multi-coin Cake Wallet, a Bitcoin privacy educator and a moderator of the r/CryptoCurrency subreddit.

Coinbase kom for nylig under beskydning efter en Anmodning om lov om informationsfrihed fra Teknisk forespørgsel afslørede detaljer om sin kontrakt om at give US Immigration and Customs Enforcement (ICE) adgang til deres blockchain-analyseværktøj Coinbase Tracer.

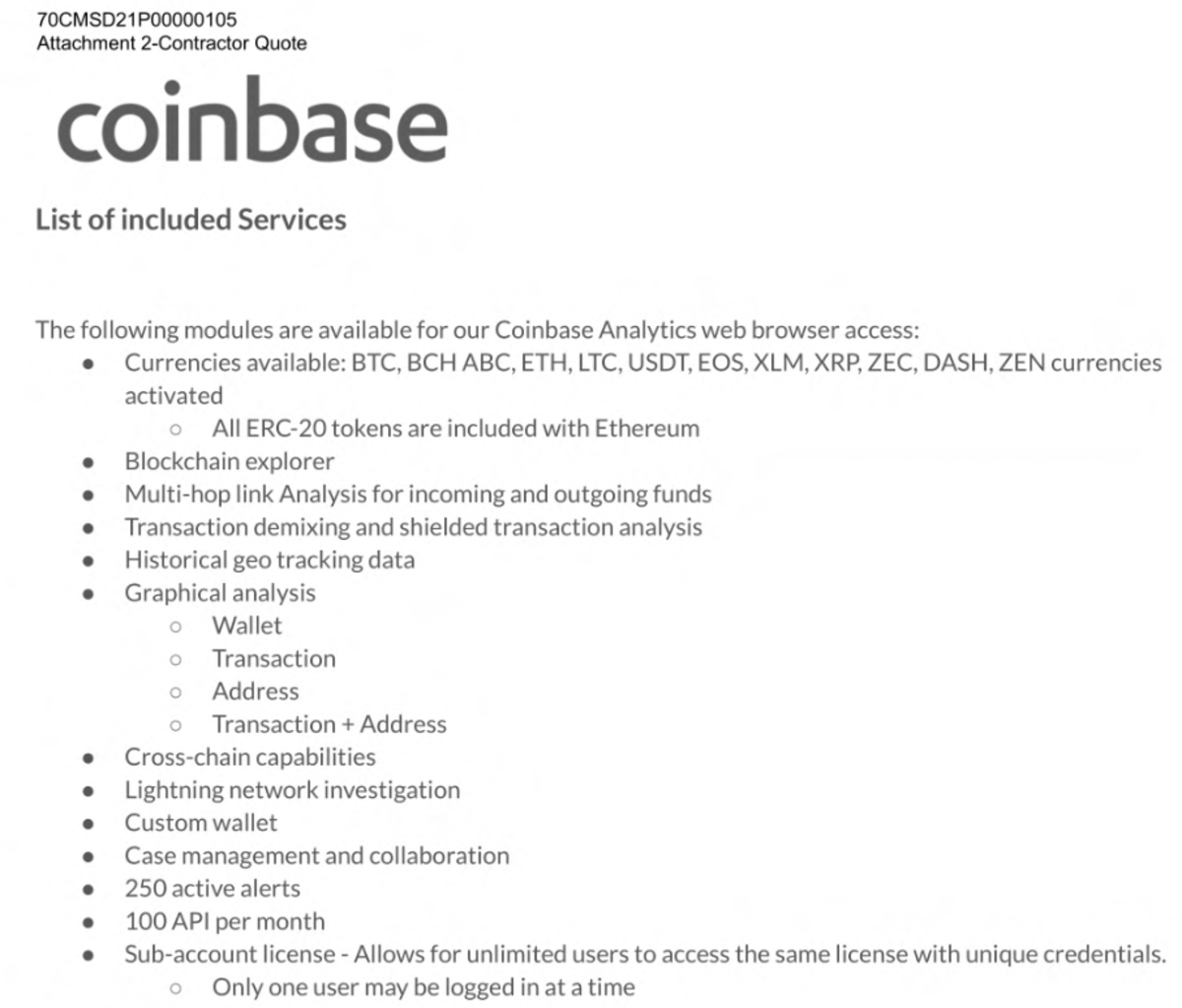

Coinbase agreed to provide ICE with surveillance data on 12 blockchains (including Bitcoin’s). Among other tools, ICE gained access to Coinbase’s “multi-hop analysis,” “Lightning network investigation,” “historical geo tracking data” and “transaction demixing and shielded transaction analysis.” You can see a summary of the scope in this screenshot obtained by Tech Inquiry:

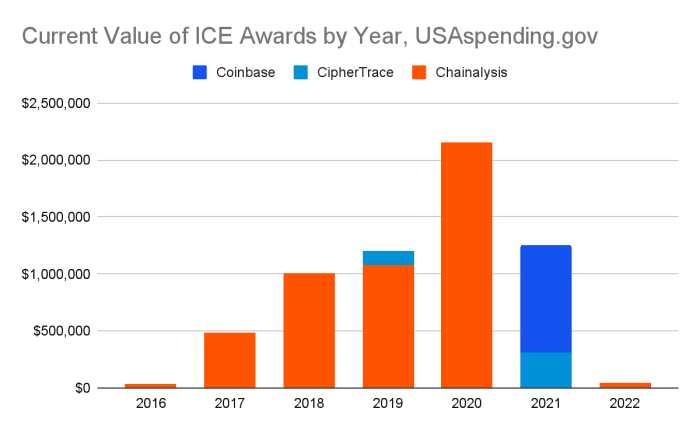

For fortalere for privatlivets fred og fagfolk i overholdelse af kryptovaluta er eksistensen af disse funktioner ikke overraskende. Chainalysis, CipherTrace, Elliptic og andre blockchain-analysefirmaer har solgt lignende tjenester i mange år. I henhold til skemaet nedenfor har ICE købt licenser fra Chainalysis siden 2016.

Omfanget af blockchain-overvågning, der engang var skjult for offentligheden, er nu ved at blive almindeligt kendt. Chainalysis, CipherTrace, Elliptisk , Coinbase alle præsenterer deres tilbud om overholdelsesværktøjer.

Kædelyse tilbud Reaktor for regulatorer og efterforskere, KYT ("kend din transaktion") til automatisk overholdelsesscreening af adresser og transaktioner, Kryptos til kontrol på højt niveau, Marked Intel for forskere og investorer, Forretningsdata for udvekslinger for at spore deres kunders aktiviteter til forretningsudvikling, og Respons på kryptohændelser for ofre for ransomware og andre trusler. Blockchain-overvågningsdata sælges til overholdelse, forskning, investering og markedsføringsformål af samme virksomhed. Og der er snesevis af andre virksomheder, der sælger lignende data til andre formål.

ICE-nedfaldet

Følgende en bølge af negativ trykke efter at detaljerne i Coinbase's kontrakt med ICE blev frigivet, børsen gentog at det "ikke sælger proprietære kundedata", og at "Coinbase Tracer henter sine oplysninger fra offentlige kilder og ikke gør brug af Coinbase brugerdata. Nogensinde."

Jeg vil acceptere Coinbases påstande på overfladen, men selvom det er sandt, deler det stadig kundedata med den amerikanske regering.

Dine 'Ejendomsbeskyttede' data er sandsynligvis allerede delt, hemmeligt

Coinbase er krævet af loven at indsende rapporter om mistænkelige aktiviteter (SAR'er) til Financial Crimes Enforcement Network (FinCEN), hvis det mener, at visse aktiviteter er mistænkelige. Disse rapporter kan omfatte kundeoplysninger såsom navne, fysiske adresser og endda kryptovalutatransaktioner og adressedata, hvis det er relevant.

BitAML, et compliance-konsulentfirma med fokus på anti-hvidvaskning af penge (AML), har en guide til indsendelse af kryptovaluta-relaterede SAR'er på sin hjemmeside, which you can use to get a feel for the information that bitcoin exchanges commonly submit. SARs can be filed for all sorts of things, including situations where a customer refuses to comply with information requests.

Banker indgiver valutatransaktionsrapporter (CTR'er) for alle daglige kontantindskud eller udbetalinger over $10,000. CTR'er er i øjeblikket ikke nødvendige for cryptocurrency-overførsler (f.eks. hævninger på $20,000 i BTC fra en udvekslingsplatform), men FinCEN har presset på for disse tidligere. It’s likely that CTRs will be required for cryptocurrencies (as they allow users to hold their private keys and their ability to spend the coins, thus making them bearer instruments, like cash) in the near future. I can’t speak for Coinbase or whether it has submitted any CTRs, but Coinbase or other bitcoin exchanges may have already sent your information to FinCEN if you have deposited or withdrawn more than $10,000 in BTC via their platforms in a single day.

If Coinbase’s blockchain monitoring or compliance tools indicate that some bitcoin transaction on its platform is suspicious, it’s reasonable to expect that the exchange has submitted a SAR. ICE can easily use the blockchain analysis tool to find suspects of what it deems “financial crimes,” and then check to see if Coinbase or other exchanges have submitted SARs on those users.

Coinbase deler muligvis ikke kundedata direkte med ICE, men de deler kundedata, hvor det kræves, med FinCEN, som kan dele dem med ICE. Så det er naturligt, at ICE i høj grad bruger Coinbase-sporingsværktøjet til at hjælpe med at spore og lære identiteten af visse Coinbase-kunder.

Du får ikke besked om, at dine oplysninger deles i en SAR. SAR'er er eksplicit skal være hemmelig. Børser og banker har forbud mod at give dig besked. Deprimerende nok, som obligatoriske ansøgninger, ingen af denne massedataindsamling kræver en kendelse.

Dine "Ejendomsbeskyttede" data er offentlige

People should understand that the only truly “proprietary” information to Coinbase is the information you share directly with it. When you deposit and withdraw cryptocurrencies, you create public records that are usually trivially traced. If you withdraw bitcoin from Coinbase to your noncustodial wallet, Coinbase’s tool will likely show that transaction leaving Coinbase.

IP address surveillance is a large industry on its own. Bitcoin nodes are ultimately public servers. When you send bitcoin, the transaction needs to make its way into a public database. Companies run Bitcoin nodes to indsamle den første IP-adresse, de kan finde forbundet med en transaktion. In many cases, this gives these companies a good idea of your rough geographical location and sometimes even your home IP address.

That’s right: your home IP address, your wallet addresses and every transaction you ever make can be public information that is analyzed, packaged nicely and sold as tools to law enforcement. Per USAspending.gov, ICE alone has gotten access to these by issuing contracts currently valued at $6 million. The FBI and IRS have issued contracts to four analysis companies for $13.5 million and $17 million, respectively. The FBI contracts have a potential total value of over $40 million. Across all of these agencies and others, the cost to taxpayers could be as high as $79 million.

Anger Against Coinbase er ikke løsningen

Du kan være vred på Coinbase på dette tidspunkt. Vær det ikke.

Nå, i det mindste ikke lige være vred på det. Chainalysis har tjent mange flere penge fra ICE og andre bureauer gennem årene, som Coinbase har, og hvis Coinbase ikke solgte ICE dette værktøj, kunne ICE bygge det selv.

Så du burde virkelig være vred på blockchains, der muliggør masseovervågning af al denne transaktionsinformation, og være vred over den garantiløse masseovervågning, der tilbydes med SAR'er og CTR'er.

So, what do we do from here? It takes three things to enable better Bitcoin privacy:

- Set the record straight about the usefulness of these tools. They enable mass surveillance on nearly everything you do with your bitcoin. Stop beating around the bush and accept that a privacy problem exists for the 12 listed blockchains (including Bitcoin’s and Ethereum’s), as well as nearly all others.

- Incorporate meaningful and significant changes to break these tools. Hide the IP addresses being used to broadcast transactions better with tools like Dandelion++. Hide the amounts, addresses and transaction graphs. Bitcoin needs better default privacy protections to circumvent this mass surveillance. It’s almost impossible to kill these tools completely, but we can meaningfully reduce their surveillance scope by following Monero’s footsteps, for instance, of enabling sane privacy defaults across the board, not just for users of a niche tool.

- Stop using regulated entities that need to report SARs and CTRs. Using a noncustodial wallet to send more than $10,000 in bitcoin could prevent your information from being shared automatically.

Hvorfor betyder dette spørgsmål?

Bitcoin proponents have championed the usefulness of BTC for pengeoverførsler til El Salvador and other countries. Bitcoin is certainly useful in many of these circumstances. However, many migrant workers are going to be scared off by Bitcoin’s transparency and the millions of dollars being poured into tracing Bitcoin transactions annually. It’s harder for ICE to target individual users of the traditional, centralized remittance system than it is for ICE to observe every single bitcoin payment to find many going to El Salvador exchanges, IP addresses and services.

Migrant workers often escape dangerous situations back home. Regardless of your political views on immigration, one should understand how someone in this situation would take great caution in protecting their privacy for fear of being deported.

Sadly, Bitcoin doesn’t protect the privacy of the vast majority of its users very well. Suppose El Salvador was to take the extreme (though very unlikely) step of kræver remittances in itcoin. Would this be a net positive, breaking people away from centralized and regulated institutions that profit heavily off of the world’s poor? Or would this be a net negative, since one, most people will use regulated platforms to buy and sell bitcoin with fees anyways, and two, the vast majority of people will be surveilled by enemy actors (from the perspective of illegal immigrants) on the transparent blockchain?

The answer isn’t straightforward; there are positives and negatives, and Bitcoin will be the preferred option for some people. Still, I hope that loud voices in the Bitcoin community understand the challenges and risks associated with ICE watching every transaction, and that they loudly advocate for better default privacy protections on Bitcoin to protect the users they say Bitcoin was made for.

This is a guest post by Justin Ehrenhofer. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.

- Bitcoin

- Bitcoin Magazine

- blockchain

- overholdelse af blockchain

- blockchain konference

- Blockchain overvågning

- virksomhed

- kædeanalyse

- coinbase

- coingenius

- Konsensus

- kryptokonference

- krypto minedrift

- cryptocurrency

- decentral

- Defi

- Digitale aktiver

- ethereum

- ICE

- machine learning

- ikke fungibelt symbol

- Udtalelse

- plato

- platon ai

- Platon Data Intelligence

- PlatoData

- platogaming

- Polygon

- Beskyttelse af personlige oplysninger

- bevis for indsatsen

- W3

- zephyrnet