- ISDA A SIMM v2.5 3. december 2022-én lép hatályba

- Frissítve teljes újrakalibrációval és iparági utólagos teszteléssel

- Jelentése Kezdeti Margó will change for most portfolios

- In particular, material increases for Commodity and Credit risks

- A SIMM v2.5 tényleges hatásának számszerűsítése

- Clarus CHARM can run both SIMM v2.5 and v2.4 on your portfolios

- And do so before go-live, to analyse and take action

változat 2.5

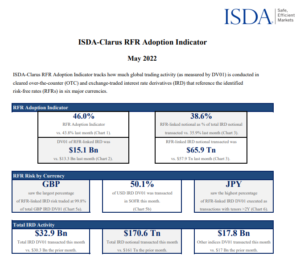

Az ISDA közzétette ISDA SIMM v2.5 with a full re-calibration of risk weights, correlations and thresholds. The calibration period is a 1-year stress period (Sep-08 to Jun-09, the Great Financial Crisis) and the 3-year recent period ending Dec 2021 (or possibly later, but at time of writing I cannot find this specified, so am going by prior years, if you do know, please add a comment).

So the Covid-19 market volatility in February/March 2020 remains in SIMM v2.5, just as it was in SIMM v2.4, but was not included in SIMM v2.3 calibration. In addition the higher volatility we saw in late 2021 in certain markets e.g. Energy, will be included.

CHARM

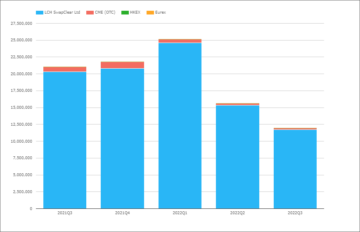

Clarus vásárlói használnak CHARM or Mikro szolgáltatások are able to easily run SIMM v2.5 and compare the margin with SIMM v2.4 for their actual or hypothetical portfolios, before the go-live date:

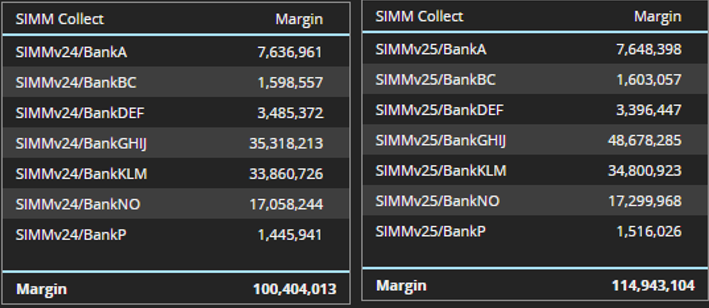

- The total gross margin for these increasing from $100million to $115 million

- (While in v2.3 it was $90 million for these same portfolios)

- An increase of 15% for the total margin, significant indeed

- Fontosabbak a partnerportfólió szintű változások

- Ezek pedig igen széles variációt mutathatnak

- A BankGHJ 35 millió dollárról 49 millió dollárra nő, ami 38%-os növekedést jelent

- A jump close to the important $50m level, above which margin is exchanged

- (A részletezés azt mutatná, hogy ez a növekedés a hitel és részvény termékosztályokból származik)

- Most portfolios with small increases, a few flat

Nem meglepő módon az IM változásának lényegessége a portfólió kockázati tényezőitől függ, és ez a változás lehet nagy vagy kicsi, növekedés vagy csökkenés.

The only way to really know is to calculate SIMM v2.5 on your actual portfolios and compare results, which CHARM makes it easy to do, months before the actual change when the market switches to SIMM v2.5 on December 3, 2022. Foresight is forewarned and allows for better planning of collateral requirements and opens up the potential of pre-emptive actions.

It is possible to eyeball the new risk weights, correlations and thresholds in SIMM v2.5, compared to SIMM v2.4 and highlight a few of the more obvious impacts on margin.

SIMM v2.5 vö. v2.4

Tegyük ezt kockázati osztályok szerint.

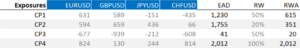

Devizaárfolyam kockázat

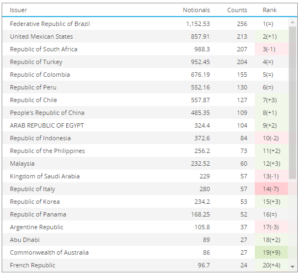

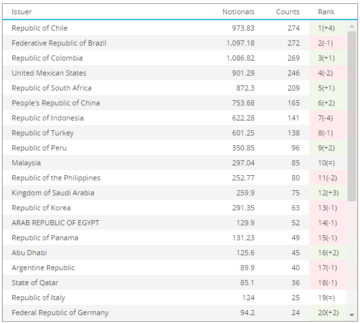

- BRL, RUB, TRY and ZAR are now high volatility currencies with a risk weight of 13.6, up from 13

- While ARS & MXN drop down to regular volatility currencies with 7.4 risk weight

- While in SIMM v2.3 there were no high volatility currencies

- RUB the one new high volatility currency, not surprising given the Ukraine situation

- Leading to a doubling of IM for RUB NDFs

- Vega risk weight remains at 0.47, which was up from 0.30 in v2.3

Kamatkockázat

- Cross currency basis swap spread risk weight stays the same as 21

- Inflation risk weight is 63, down from 64, which was up from 50 in SIMM v2.3

- Vega risk weight stays the same at 0.18

- Interest rate risk weights are categorized into regular, low and high volatility currencies and within these tenor buckets.

- Regular and low volatility (only jpy) currencies risk weights are largely un-changed except for small increases below 3M tenors.

- High volatility currencies have low single digit percentage increases in risk weights, with 15Y showing the largest increase of 7%

- So not a lot of note in IR

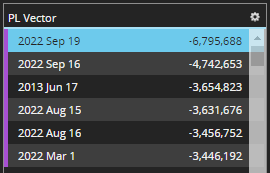

- Unlike CCP IM models, where the massive volatility in GBP Rates this week, shows up:

- As historical risk scenarios are updated daily by CCPs

- Note that 4 of the worst 6 tail scenario dates for a GBP receive fixed swap are in 2022

- With the 5-day period starting 19-Sep-2022, nearly double the 17-Jun-2013 value!

- Cleared GBP IR Swaps and Futures portfolios will be seeing large VM and IM moves

Részvénykockázat

- Equity risk weights are the same or a touch higher or lower than SIMM v2.4

- Bucket 3, EM basic materials, energy, agriculture, manufatirubg and mining, up the most from risk weight 30 to 34

- The vega risk weight is down to 0.45 from 0.50, which was up from 0.26

- Correlations a touch lower for all buckets

Árukockázat

- Large risk increases in several SIMM buskets

- Coal up from 22 to 27 risk weight

- European Natural Gas up from 22 to 40

- North American Power up from 49 to 53

- European Power and Carbon up from 24 to 44

- Freight and Other up from 53 to 58

- The rest the same

- Vega risk weight is similar at 0.60 to 0.61 from 0.41

- Histroic Volatility ratio ip from 64% to 69%

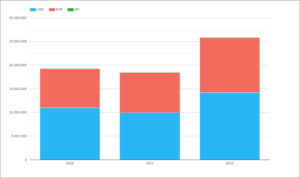

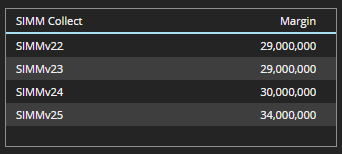

A hypothetical portfolio with Delta positions of $1m in each of the above named categories, would change with SIMM version as below (up 36% from v24 and up 49% from v23):

Hitel Minősítő kockázat

- Risk weights for Investment Grade sectors are mostly lower except for Technology (bucket 5), which is up from 59 to 67

- Risk weights for High Yield (HY) and non-rated (NR) sectors mostly higher, with Financials (bucket 8) significantly higher from 452 to 665 and Healthcare, utilities, local government (bucket 12) up from 195 to 247

- Residual risk weight up to 665 from 452, which itself is up from 333 and 250 in prior versions

- Vega risk is similar at 0.74 compared to 0.73

- So higher IMs for HY and EM credit default swaps

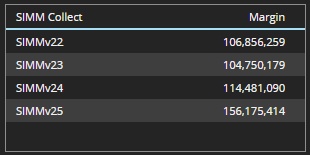

A hypothetical portfolio with Credit positions of $100k CS01 buckets 8 and 12, would change with SIMM version as below (up 47% from v24 and up 87% from v23):

Hitelkockázat, nem minősíthető

- Risk weights for Investment Grade RMBS/CMBS are un-changed at 280

- Risk weights for High Yield RMBS/CMBS are up to 1,300 from 1,200

- All other buckets also up to 1,300 from 1,200

- Correlations between same group down to 82% from 86% and different groups 27% from 33%

Koncentrációs küszöbök

Concentration thresholds changes for SIMM for large concentrated portfolios and I am out of time to summarize these, suffice to say some have decreased (e.g. FX) and others have increased (Equity Developed market Large Cap). Decreases mean IM increases quicker for large concentrated portfolios, while increases mean IM increases later for large concentrated portfolios.

A teljes részletekért lásd a SIMM v2.5, SIMM v2.4 és a SIMM v2.3 dokumentáció.

Ez az

A SIMM v2.5 új kockázati súlyokkal és összefüggésekkel rendelkezik.

Összefoglalót adunk a kockázati súly változásairól.

Energy Commodity risk with significantly higher IM.

Credit High-Yield also with higher IM.

To get an accurate understanding of IM changes.

You need to run SIMM v2.5 on your existing counterparty portfolios.

CHARM és a Mikro szolgáltatások egyszerű módot nyújtanak erre.

Kapcsolatfelvétel ha érdekli ez a gyakorlat.

Certainly worthwhile with just over two months to go to Dec 6, 2022.

- hangya pénzügyi

- blockchain

- blockchain konferencia fintech

- harangjáték fintech

- clarus

- coinbase

- coingenius

- kripto konferencia fintech

- FINTECH

- fintech alkalmazás

- fintech innováció

- ISDA SIMM

- Nyílt tenger

- PayPal

- paytech

- fizetési mód

- Plató

- plato ai

- Platón adatintelligencia

- PlatoData

- platogaming

- razorpay

- Revolut

- Ripple

- square fintech

- csík

- tencent fintech

- Xero

- zephyrnet