New earning opportunities on Ethereum

Leading decentralized exchange dYdX has announced the delivery of its long-awaited governance token. The DYDX token is now live with initial distribution planned over the coming 28 days.

Founded back in 2017 by ex-Coinbase and Uber engineer, Antonio Juliano, dYdX is a leading decentralized exchange offering perpetual, margin, and spot trading, as well as borrowing and lending pools on Ethereum. With the launch of the governance token, the platform prepares for the next stage of its evolution, handing over control to its community through the DYDX token itself.

Alongside the launch of its native DYDX token, the protocol is also rolling out several other features to help strengthen the community and service. These include a new governance product, retrospective mining rewards for past users of dYdX protocols, and liquidity mining rewards for traders and liquidity providers on dYdX’s layer-2 perpetual markets. Additionally, a liquidity staking pool is being introduced for USDC stakers to earn in exchange for liquidity and a safety pool, where DYDX stakers can earn rewards for securing the system.

The token will allow the dYdX community to truly own and govern the protocol. Through shared control, the decentralized exchange hopes to align incentives between traders, liquidity providers, and wider stakeholders. Implementing a robust ecosystem around governance, rewards, and staking. Each is designed to drive future growth and further decentralization of the platform.

Token allocations

A total of 1,000,000,000 DYDX tokens have been minted and will become accessible over the next 5 years. It is worth looking into this deeper as even if users performed a simple action on dYdX at some point in the past there could be an allocation of tokens waiting for them.

A maximum perpetual inflation rate of 2% per year will increase the supply of DYDX starting after 5 years. Ensuring the community continues to have the resources to continue contributing. Furthermore, because of the new way in which dYdX will now be governed. Even though the community allocation has been set out as above, DYDX holders will have full control over how the community allocation is used moving forward.

Earning with DYDX

The DYDX token can be earned in one of the following two ways. Users can either collect rewards by using the protocol or alternatively earn through staking USDC or DYDX to pools.

Currently, the staking periods are set to 28-day cycles. During each cycle, all DYDX earned from retroactive, trading, or liquidity mining rewards will only become transferable at the end of the cycle. Importantly, during that same cycle, any DYDX earned from safety or liquidity staking pools can be withdrawn at any time.

Trading rewards represent the simplest way to earn. An amount of DYDX is distributed to traders based on a formula that rewards a combination of fees paid and open interest. The DYDX will be distributed on a 28-day cycle and will not be bound by any lockups or vesting restrictions. More information about trading rewards can be found here. Vitally, to incentivize liquidity DYDX will be distributed to liquidity providers based on a formula that rewards participation in markets, bid-ask spread, and uptime on dYdX.

Retroactive mining

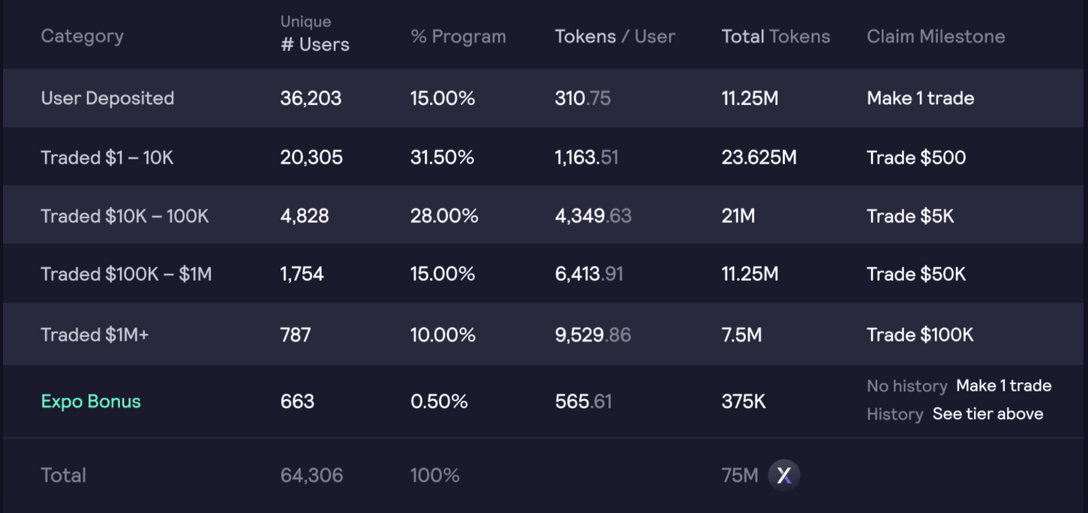

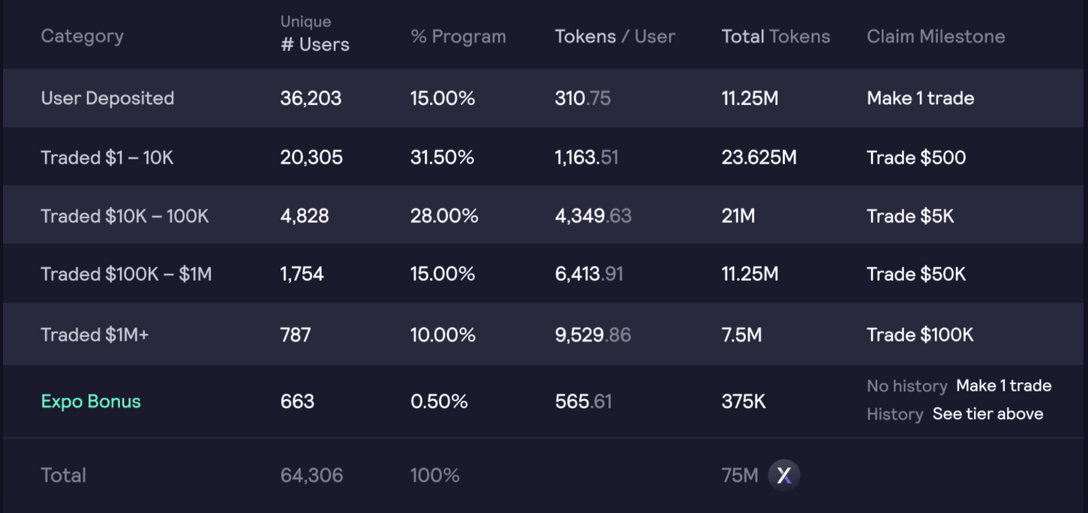

dYdX attributes its success over the last three years to the thousands of community members that have traded on the platform. As such, DYDX has been allocated to historical users of all dYdX protocols based on a snapshot ending on July 26th. There are five allocation tiers based on usage of the protocol and in line with restrictions on the platform in the USA. To claim DYDX historical users must meet certain requirements on the Layer-2 protocol as outlined below. More information about retroactive mining rewards can be found here.

You can find the full details of the earning and staking opportunities using DYDX here. Historical users of dYdX can view their past activity and tier for retroactive mining here. While staking USDC to the liquidity staking pool can start earning you rewards here. Once collected those rewards can then be placed in the safety pool for further rewards.

.mailchimp_widget {

text-align: center;

margin: 30px auto !important;

display: flex;

border-radius: 10px;

overflow: hidden;

flex-wrap: wrap;

}

.mailchimp_widget__visual img {

max-width: 100%;

height: 70px;

filter: drop-shadow(3px 5px 10px rgba(0, 0, 0, 0.5));

}

.mailchimp_widget__visual {

background: #006cff;

flex: 1 1 0;

padding: 20px;

align-items: center;

justify-content: center;

display: flex;

flex-direction: column;

color: #fff;

}

.mailchimp_widget__content {

padding: 20px;

flex: 3 1 0;

background: #f7f7f7;

text-align: center;

}

.mailchimp_widget__content label {

font-size: 24px;

}

.mailchimp_widget__content input[type=”text”],

.mailchimp_widget__content input[type=”email”] {

padding: 0;

padding-left: 10px;

border-radius: 5px;

box-shadow: none;

border: 1px solid #ccc;

line-height: 24px;

height: 30px;

font-size: 16px;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”] {

padding: 0 !important;

font-size: 16px;

line-height: 24px;

height: 30px;

margin-left: 10px !important;

border-radius: 5px;

border: none;

background: #006cff;

color: #fff;

cursor: pointer;

transition: all 0.2s;

margin-bottom: 10px !important;

margin-top: 10px !important;

}

.mailchimp_widget__content input[type=”submit”]:hover {

box-shadow: 2px 2px 5px rgba(0, 0, 0, 0.2);

background: #045fdb;

}

.mailchimp_widget__inputs {

display: flex;

justify-content: center;

align-items: center;

}

@media screen and (max-width: 768px) {

.mailchimp_widget {

flex-direction: column;

}

.mailchimp_widget__visual {

flex-direction: row;

justify-content: center;

align-items: center;

padding: 10px;

}

.mailchimp_widget__visual img {

height: 30px;

margin-right: 10px;

}

.mailchimp_widget__content label {

font-size: 20px;

}

.mailchimp_widget__inputs {

flex-direction: column;

}

.mailchimp_widget__content input[type=”submit”] {

margin-left: 0 !important;

margin-top: 0 !important;

}

}

The above does not constitute investment advice. The information given here is purely for informational purposes only. Please exercise due diligence and do your research. The writer holds positions in ETH, BTC, ADA, NIOX, AGIX, MANA, SAFEMOON, SDAO, CAKE, HEX, LINK, GRT, CRO, SHIBA INU, AND OCEAN.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- DappRadar

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- PlatoData

- platogaming

- Polygon

- proof of stake

- W3

- zephyrnet