SNEAK PEEK

- Ethereum fees reach an all-time high amid network congestion.

- Rising trading volume suggests increasing demand for ETH.

- Multiple indicators indicate a potential trend reversal for Ethereum.

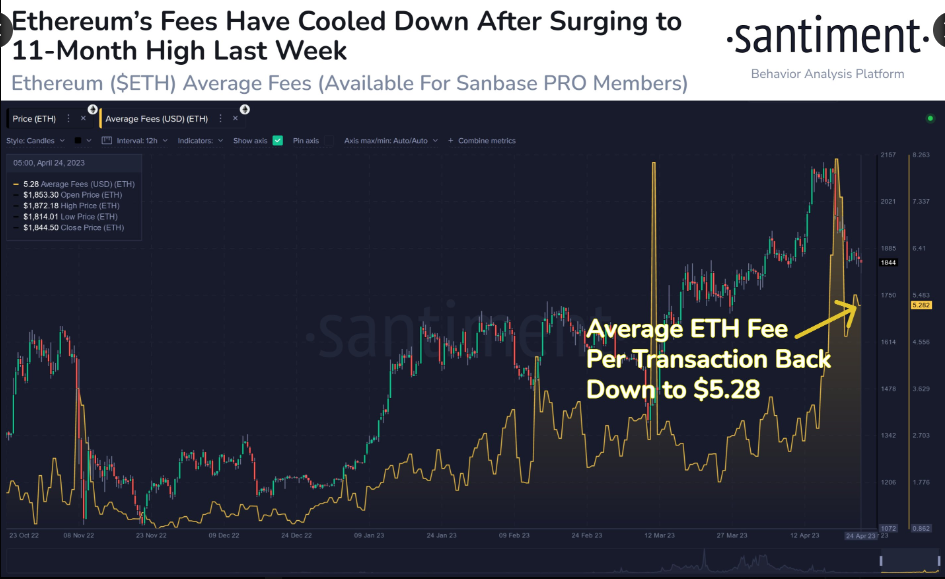

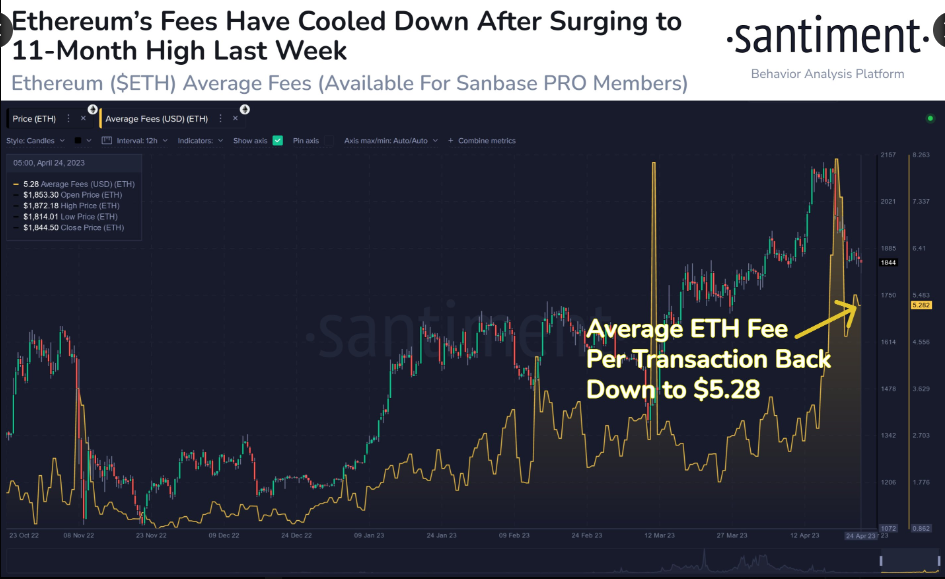

After falling below $2k last week, Ethereum‘s fees have risen to their highest level since May 2022. This shift was brought about by increasing network transaction demand, which caused congestion and delayed processing times. Though still high, costs have been reduced by 35%, alleviating consumer restraints and boosting network use.

💵 After crossing back under $2k last week, #Ethereum‘s network saw its fees explode to their highest level since May, 2022 as traders polarized and figured out whether to buy or sell. Though still relatively high, fees have been discounted by 35% since. https://t.co/z8AMJr57V4 pic.twitter.com/AIyDWrL5dG

— Santiment (@santimentfeed) April 24, 2023

Despite this, the bear’s hand was strong in the ETH market, with prices falling from a 24-hour high of $1,874.11 to an intraday low of $1,811.79. As of press time, the price of ETH has dropped by 1.60% to $1,817.41.

The market capitalization of ETH fell by 1.72% to $218,700,376,936, while the 24-hour trading volume increased by 9.88% to $7,960,648,581. This rise in trading volume and decrease in fees imply a rising demand for ETH, which might lead to a price hike soon.

The Fisher Transform line, which has a value of -1.22 and is below the signal line on the 4-hour price chart for the ETH market, indicates that the market is oversold and that a potential buy signal is approaching. The reversal will be apparent if the Fisher transform line crosses the signal line successfully.

By indicating escalating selling pressure, the Money Flow Index (MFI), which has a reading of 18.89 and is trending downward, supports the bearish momentum in ETH. Traders should exercise caution when evaluating long positions if the MFI declines and breaks below the oversold level. This movement may signal the start of a more severe downward trend.

ETH may still be under short-term negative pressure as the Relative Strength Index (RSI), currently reading 37.54, falls below its signal line and into the oversold zone. As a result, traders can decide to wait to enter an extended position until the RSI rises above its signal line and leaves the oversold area.

On the 4-hour price chart, the stochastic RSI has a reading of 59.74, which is below its signal line. This action indicates that the asset is oversold and may shortly revert bullishly to the upside. If the stochastic RSI passes the signal line on the ETH market, it can indicate a potential trend reversal or shift in momentum.

Ethereum’s price drop and rising trading volume suggest a possible momentum shift, but caution is advised as the market remains oversold.

Disclaimer: Cryptocurrency price is highly speculative and volatile and should not be considered financial advice. Past and current performance is not indicative of future results. Always research and consult with a financial advisor before making investment decisions

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://investorbites.com/ethereum-eth-price-analysis-25-04/

- :has

- :is

- :not

- 1

- 11

- 2022

- 22

- 35%

- 9

- a

- About

- above

- Action

- advice

- advisor

- After

- always

- Amid

- an

- analysis

- and

- apparent

- approaching

- AREA

- AS

- asset

- back

- BE

- bearish

- Bearish Momentum

- been

- before

- below

- boosting

- breaks

- brought

- but

- buy

- by

- CAN

- capitalization

- caused

- Center

- Chart

- considered

- consumer

- Costs

- Current

- Currently

- decide

- Declines

- decrease

- Delayed

- Demand

- discounted

- discussion

- Dominance

- downward

- Drop

- dropped

- Eases

- Enter

- ETH

- eth market

- ETH/USD

- ethereum

- Ethereum News

- Ethereum Price

- Ethereum Price Analysis

- evaluating

- Exercise

- extensive

- external

- Falling

- Falls

- Fees

- figured

- financial

- financial advice

- flow

- For

- from

- future

- hand

- Have

- High

- highest

- highly

- Hike

- HTTPS

- in

- increased

- increasing

- index

- indicate

- indicates

- Indicators

- internal

- into

- investment

- IT

- ITS

- Last

- lead

- Level

- Line

- Long

- Low

- Making

- Market

- Market Capitalization

- Market News

- max-width

- May..

- might

- Momentum

- money

- more

- movement

- negative

- network

- news

- of

- on

- or

- passes

- past

- performance

- plato

- Plato Data Intelligence

- PlatoData

- position

- positions

- possible

- potential

- press

- pressure

- price

- Price Analysis

- price chart

- Prices

- processing

- reach

- Reading

- Reduced

- relative strength index

- relatively

- remains

- research

- result

- Results

- Reversal

- revert

- Rise

- Risen

- Rises

- rising

- rsi

- Santiment

- sell

- Selling

- severe

- shift

- short-term

- Shortly

- should

- Signal

- since

- Source

- start

- Still

- strength

- strong

- Successfully

- Suggests

- Supports

- that

- The

- their

- this

- time

- times

- to

- Traders

- Trading

- trading volume

- TradingView

- transaction

- Transform

- Trend

- trending

- under

- Upside

- use

- value

- volatile

- volume

- wait

- was

- week

- What

- What is

- when

- whether

- which

- while

- will

- with

- zephyrnet